Reliance Industries Ltd share price target 2025, 2030, 2035, 2040, 2050

Reliance Industries Share Price Forecast: 2025, 2030, 2035, and 2050

Reliance Industries Share Price Forecast: 2025, 2030, 2035, and 2050

Reliance Industries Limited (RIL) is one of India’s largest conglomerates, with businesses spanning energy, telecommunications, retail, and digital services. Given its consistent growth trajectory, investors are keen to understand the future of its stock price. Based on historical revenue growth and share price trends, we project Reliance Industries’ stock performance for 2025, 2030, 2035, and 2050.

Historical Performance & CAGR Analysis

From 2015 to 2024, Reliance Industries has experienced steady revenue growth. The company’s revenue increased from ₹3,74,372 crore in 2015 to ₹8,99,041 crore in 2024. This reflects a Compound Annual Growth Rate (CAGR) of 10.22% over the past nine years. Given the company’s diverse business portfolio and continuous expansion, we use this CAGR to estimate its future stock price.

Projected Share Prices

Assuming that the share price grows in proportion to revenue growth, we estimate the future share prices of Reliance Industries as follows:

Year | Estimated Share Price (₹) |

2025 | 1,381 |

2030 | 2,247 |

2035 | 3,656 |

2050 | 15,744 |

These projections assume that Reliance Industries will continue expanding at a similar pace, benefiting from its market leadership, digital transformation, and strategic investments.

Factors Influencing Future Growth

- Jio & Digital Expansion – With Jio’s dominance in India’s telecom sector, future expansion into AI, 5G, and digital payments can drive further growth.

- Retail & Consumer Businesses – Reliance Retail’s rapid expansion in e-commerce and physical stores will add significant revenue streams.

- Green Energy Initiatives – RIL’s push into renewable energy and hydrogen-based technologies will likely create new opportunities for expansion.

- Macroeconomic Conditions – India’s GDP growth, regulatory policies, and global economic trends will influence Reliance’s performance.

Conclusion

Reliance Industries remains a strong long-term investment, backed by diversification and innovation. While short-term market volatility can impact prices, the long-term trajectory looks promising, with an expected rise in stock value over the next decades. Investors should keep an eye on technological advancements and regulatory changes that could affect the company’s valuation.

Disclaimer: These projections are based on historical data and assumptions. Actual stock prices may vary based on market conditions and company performance.

Reliance Industries: A Snapshot of Financial Strength

- 10-Year Sales Growth: From ₹374,372 crore in 2014 to ₹899,041 crore in 2024, sales grew at a CAGR of approximately 9.15%. This reflects RIL’s ability to scale across sectors despite global economic fluctuations.

- 5-Year Sales Growth: From ₹568,337 crore in 2019 to ₹899,041 crore in 2024, the CAGR was around 9.61%, driven by Jio’s 5G rollout and retail expansion.

- Stock Price Growth: The stock price rose from ₹187.66 in 2014 to ₹1,485.85 in 2024, yielding a 10-year CAGR of 22.96%. Over the past 5 years (2019–2024), the price increased from ₹619.43 to ₹1,485.85, a CAGR of 19.14%.

2025: Short-Term Outlook

2030: Medium-Term Growth

2035: Long-Term Transformation

2050: Vision for the Future

Key Growth Drivers and Risks

Drivers:

- Renewable Energy: RIL’s 100 GW solar and hydrogen initiatives align with global sustainability trends.

- Digital and Retail: Jio’s 5G dominance and Reliance Retail’s offline-online synergy ensure steady revenue.

- Financial Health: Strong cash flows (₹158,788 crore in 2024) and reserves support strategic investments.

Risks:

- Debt Levels: Borrowings of ₹458,991 crore require careful management.

- Regulatory and Global Risks: Policy changes or economic downturns could impact profitability.

- Market Volatility: High P/E ratios (historically 23.7) may signal overvaluation risks.

Conclusion

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

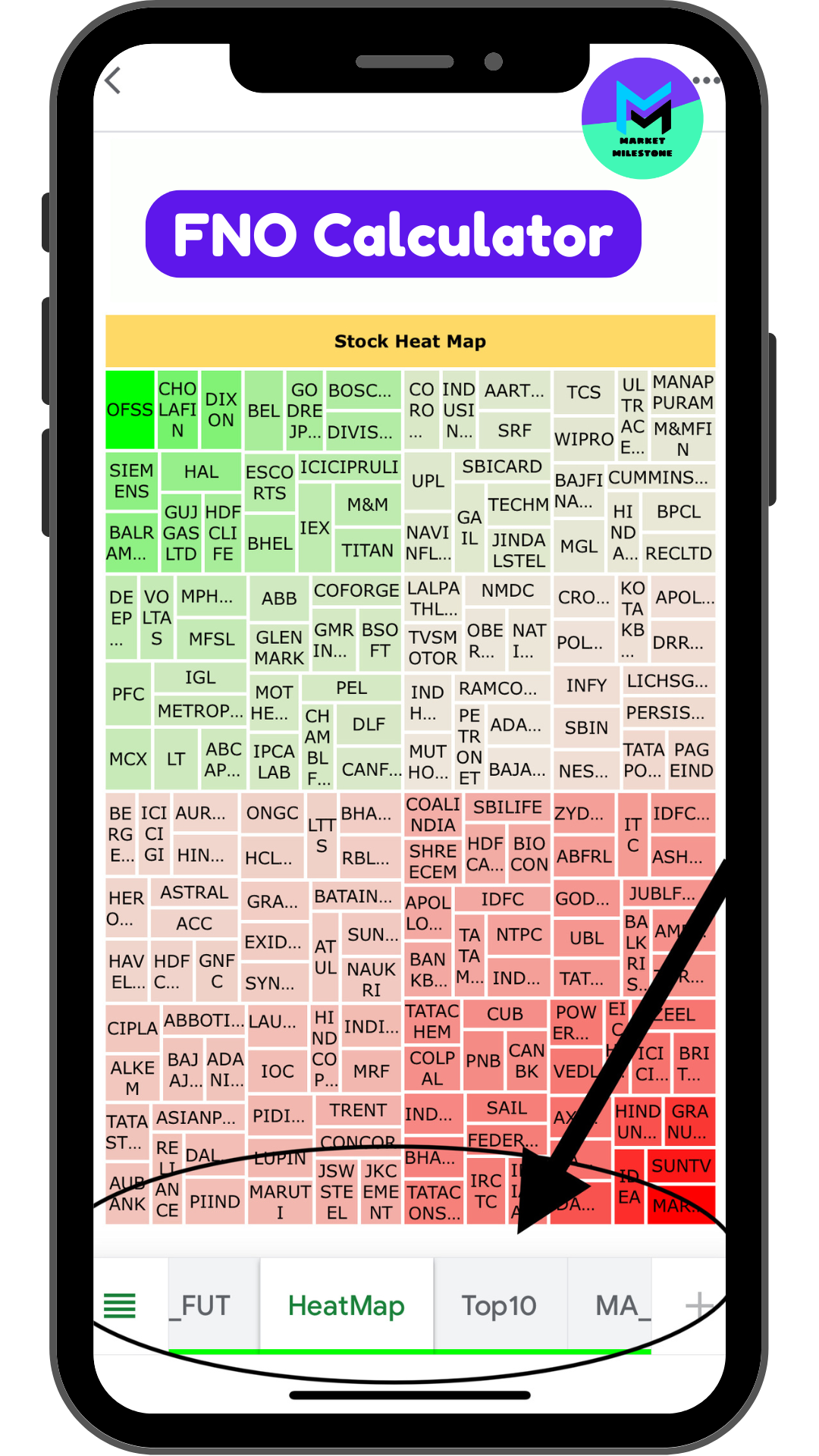

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.