Infosys Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Infosys Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Infosys Limited, a global leader in IT services and consulting, has established itself as a cornerstone of India’s technology sector. Founded in 1981 by N.R. Narayana Murthy, the company has grown into the second-largest IT firm in India, trailing only Tata Consultancy Services (TCS). With a market capitalization of approximately ₹589,556 crore as of April 2025, Infosys continues to deliver robust financial performance, driven by its expertise in digital transformation, cloud services, and artificial intelligence (AI). This blog provides a detailed forecast of Infosys Ltd’s share price for 2025, 2030, 2035, and 2050, incorporating historical Compound Annual Growth Rate (CAGR) data and recent financial insights to project future growth.

Financial Snapshot and CAGR Analysis

Infosys has demonstrated consistent financial strength. For the fiscal year ending March 31, 2025, the company reported consolidated revenue of ₹162,990 crore, a 6.06% increase from ₹153,670 crore in FY24. Net profit rose 1.83% to ₹26,713 crore, reflecting operational efficiency despite global economic challenges. The company’s market cap stood at ₹588,185.09 crore, with a P/E ratio of 22.02 and a dividend yield of 3.03% as of April 17, 2025.

Historically, Infosys has delivered a CAGR of 11.21% in stock price over the long term, with returns ranging from 12% to 18% annually over the past 15–20 years. For forecasting purposes, we assume a conservative CAGR range of 10–12% based on historical performance, industry trends, and the company’s focus on high-growth areas like AI, cloud computing, and cybersecurity. This aligns with analyst projections suggesting steady growth in the IT sector, driven by increasing global demand for digital services.

Share Price Forecast

The share price forecasts below are based on the current price of ₹1,419.50 (as of April 17, 2025) and a CAGR range of 10–12%. These projections account for Infosys’s strong fundamentals, global client base, and strategic acquisitions, such as The Missing Link, which bolster its cybersecurity capabilities. However, they also consider potential risks, including global economic uncertainties and competitive pressures in the IT industry.

2025: Near-Term Outlook

For 2025, analysts predict Infosys’s share price to range between ₹1,699.85 and ₹1,811.61, with a median target of ₹1,811.61. Applying a 10–12% CAGR from the current price, the share price could reach approximately ₹1,561–₹1,590 by year-end. This aligns with the company’s revised revenue guidance of 1.0–3.5% for FY25 and its focus on generative AI, with 80 active client projects. Strategic partnerships, such as with Danske Bank and AIB, further support this growth trajectory.

2030: Mid-Term Growth

By 2030, Infosys is expected to capitalize on the increasing adoption of advanced technologies. Analyst forecasts suggest a share price range of ₹2,758.93 to ₹7,251.50, with conservative estimates around ₹4,652–₹4,703.29. Using a 10–12% CAGR, the share price could reach ₹2,300–₹2,500. This projection reflects Infosys’s ability to maintain strong client relationships in banking, healthcare, and manufacturing, alongside its global delivery model, which ensures cost-effective scalability. The company’s focus on sustainability and innovation, including AI-driven solutions like its Stats Center for Formula E, will likely drive investor confidence.

2035: Long-Term Stability

Looking to 2035, Infosys’s share price is projected to range between ₹2,720 and ₹13,054.08, with some analysts targeting ₹4,500–₹4,700. A 10–12% CAGR yields a price range of ₹3,700–₹4,200. The company’s continued leadership in digital services, coupled with its generative AI capabilities and a robust operating margin of 20–22%, supports this outlook. However, competition from niche technology providers and cloud giants could temper growth, necessitating ongoing innovation.

2050: Vision for the Future

By 2050, Infosys’s share price could reach ₹4,050–₹69.15 (adjusted for INR equivalent) based on varied analyst projections. Applying a conservative 10–12% CAGR, the price may range from ₹10,000–₹13,000. This ambitious forecast assumes Infosys sustains its competitive edge through technological advancements, global expansion, and a skilled workforce of over 300,000 employees. Long-term investors should note that large-cap companies like Infosys typically offer stable but not multibagger returns, with growth driven by consistent performance rather than rapid spikes.

Financial Report Highlights

- Revenue Growth: ₹162,990 crore in FY25, up 6.06% YoY.

- Net Profit: ₹26,713 crore, up 1.83% YoY, despite a 11.75% decline in Q4 FY25 due to seasonal factors.

- Dividend: Final dividend of ₹22 per share proposed for FY25, reflecting shareholder commitment.

- Market Position: Market cap of ₹588,185.09 crore, with promoter holding at 14.43% and strong institutional interest (FII: 33.3%, DII: 38.02%).

- Strategic Moves: Acquisitions like Simplus and The Missing Link, alongside partnerships with Linux Foundation and Formula E, enhance Infosys’s AI and cybersecurity offerings.

Risks and Considerations

While Infosys’s outlook is positive, investors should consider risks such as global economic slowdowns, currency fluctuations, and intensifying competition from cloud providers and niche tech firms. Legal challenges, like the recent dispute with Cognizant, and external pressures, such as U.S. tariffs, could impact profitability. Additionally, the company’s training policies and layoffs have raised concerns, potentially affecting its reputation.

Conclusion

Infosys Ltd remains a compelling investment for long-term investors seeking stable returns in the IT sector. With a projected CAGR of 10–12%, the share price could grow from ₹1,419.50 in 2025 to ₹10,000–₹13,000 by 2050. The company’s strong financials, strategic acquisitions, and focus on emerging technologies position it well for sustained growth. However, investors should conduct thorough research and consult financial advisors, as market volatility and competitive pressures could influence outcomes. Infosys’s journey from a small Pune-based firm to a global IT powerhouse underscores its resilience and potential for future success.

Disclaimer: This forecast is for informational purposes only and not investment advice. Always consult a financial professional before investing.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

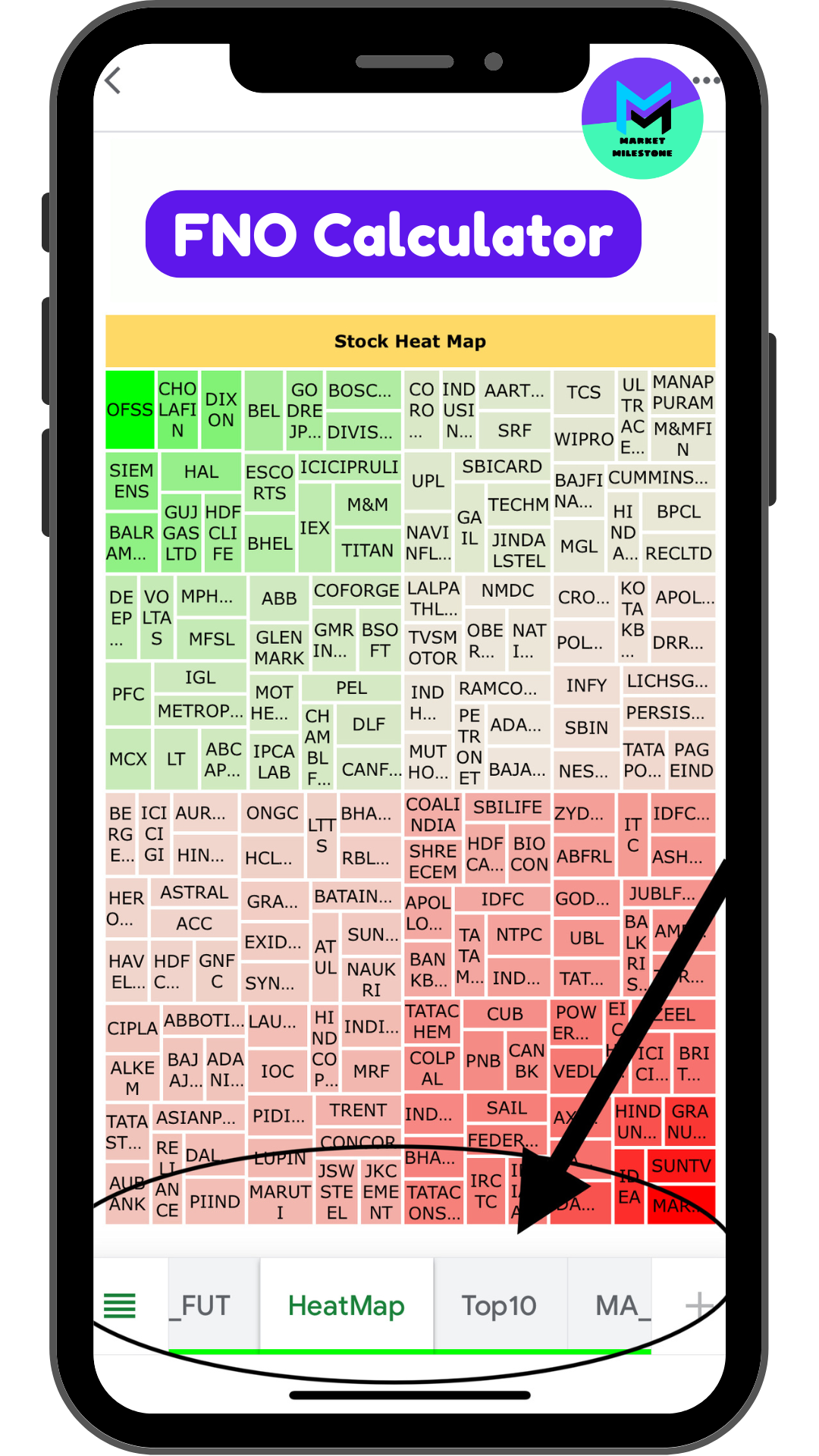

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Related posts

HCL Technologies Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Tata Consultancy Services Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2051