Eternal Zomato Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Eternal Zomato Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Eternal Limited, formerly Zomato Limited, has emerged as a powerhouse in India’s food delivery and quick commerce sectors. With its robust technology platform, extensive network, and innovative services like Blinkit and Hyperpure, Eternal (Zomato) is well-positioned for long-term growth. This blog provides an SEO-optimized share price forecast for Eternal Zomato Ltd for 2025, 2030, 2035, and 2050, incorporating a calculated Compound Annual Growth Rate (CAGR) based on available data and a concise financial overview.

Eternal Zomato Ltd: Company Overview

Eternal Limited, listed on NSE (ETEA) and BSE, operates a B2C platform under the Zomato brand, offering food delivery, restaurant discovery, and quick commerce through Blinkit. As of April 2025, the company’s market capitalization stands at approximately ₹2.29 lakh crore, with a share price of around ₹222.47 (NSE). Incorporated in 2010 and headquartered in Gurugram, India, Eternal has expanded its footprint across 800+ cities, leveraging AI, machine learning, and data analytics to enhance user experience and operational efficiency.

Financial Performance Snapshot

Eternal’s financials reflect strong growth and a path toward profitability. For the quarter ending December 31, 2024, the company reported:

- Consolidated Total Income: ₹5,657 crore, up 12.69% QoQ and 61.31% YoY.

- Net Profit After Tax: ₹59 crore.

- Revenue (FY23): ₹7,761 crore, a 55% increase from the previous year.

- Trailing Twelve Months (TTM) Profit: ₹663 crore.

Key metrics include a PE ratio of 323.21 (indicating high market expectations), a price-to-book ratio of 9.99, and a price-to-sales ratio of 13.07. The food delivery segment, contributing 44% to revenue in H1 FY25, grew 35% YoY, driven by a 24% rise in Gross Order Value (GOV). Despite a low return on equity (ROE) of -4.80% over the past three years, recent performance signals improvement.

Share Price Forecast and CAGR Calculation

To forecast Eternal Zomato’s share price, we analyze historical performance, market trends, and analyst projections. The food delivery market is expected to grow at a CAGR of 12.8% over the next decade, driven by urbanization and increasing internet penetration. Based on analyst insights and historical stock trends, we assume a conservative revenue CAGR of 15% for Eternal, factoring in its diversified portfolio and competitive pressures.

Current Share Price (April 2025)

- Price: ₹222.47 (NSE).

- 52-Week Range: ₹146.85–₹304.50.

Forecast Methodology

We use a CAGR-based model, aligning with analyst targets and market growth projections. The formula for future share price is:

\text{Future Price} = \text{Current Price} \times (1 + \text{CAGR})^{\text{Years}}

Assuming a share price CAGR of 15% (derived from revenue growth and market trends), we project the following:

- 2025 (1 Year):

- Price: ₹222.47 × (1 + 0.15)¹ = ₹255.84.

- Analyst median target: ₹280.67 (range: ₹150–₹385), supporting our estimate.

- 2030 (5 Years):

- Price: ₹222.47 × (1 + 0.15)⁵ = ₹447.29.

- Analyst projection: ~₹500 (adjusted for inflation and market dominance).

- 2035 (10 Years):

- Price: ₹222.47 × (1 + 0.15)¹⁰ = ₹900.08.

- Projection: ~₹700 (conservative estimate considering competition).

- 2050 (25 Years):

- Price: ₹222.47 × (1 + 0.15)²⁵ = ₹7,322.36.

- Projection: ~₹1,600 (factoring in global expansion and technological leadership).

These projections assume sustained growth, strategic acquisitions, and resilience against competitors like Swiggy and Amazon. However, risks such as rising competition in quick commerce and regulatory changes could impact outcomes.

Key Growth Drivers

- Market Expansion: Zomato’s presence in 800+ cities and international markets positions it to capture growing demand.

- Quick Commerce (Blinkit): Rapid delivery of everyday products is a high-growth segment, despite competitive pressures.

- Technology Innovation: AI-driven personalization and logistics optimization enhance efficiency.

- Brand Strength: Zomato’s strong brand and loyalty programs like Zomato Gold drive customer retention.

Risks to Consider

- Competition: Swiggy and regional players challenge market share.

- Profitability Concerns: High PE ratio and past losses raise valuation risks.

- Regulatory Changes: Caps on foreign ownership (49.5%) and antitrust scrutiny could impact growth.

Financial Report Summary

- Market Cap: ₹2.29 lakh crore.

- Revenue (H1 FY25): ₹17,972 crore.

- Profit: ₹663 crore (TTM).

- Shareholding (March 31, 2025):

- Promoters: 0.0%.

- FII: 44.36% (down from 47.31% in Dec 2024).

- DII: 23.44% (up from 20.47%).

- Stock Performance: 38.41% return over 3 years.

Investment Outlook

Eternal Zomato Ltd’s share price forecast reflects optimism, driven by its leadership in food delivery and quick commerce. While short-term volatility may persist due to competition and high valuations, long-term investors can expect significant returns, with projected prices of ₹255.84 (2025), ₹447.29 (2030), ₹900.08 (2035), and up to ₹1,600 (2050). Investors should conduct thorough research and consult financial advisors before investing.

Disclaimer: The above forecasts are based on available data and assumptions. Stock investments carry risks, and past performance does not guarantee future results. For the latest updates, visit Moneycontrol or Groww.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

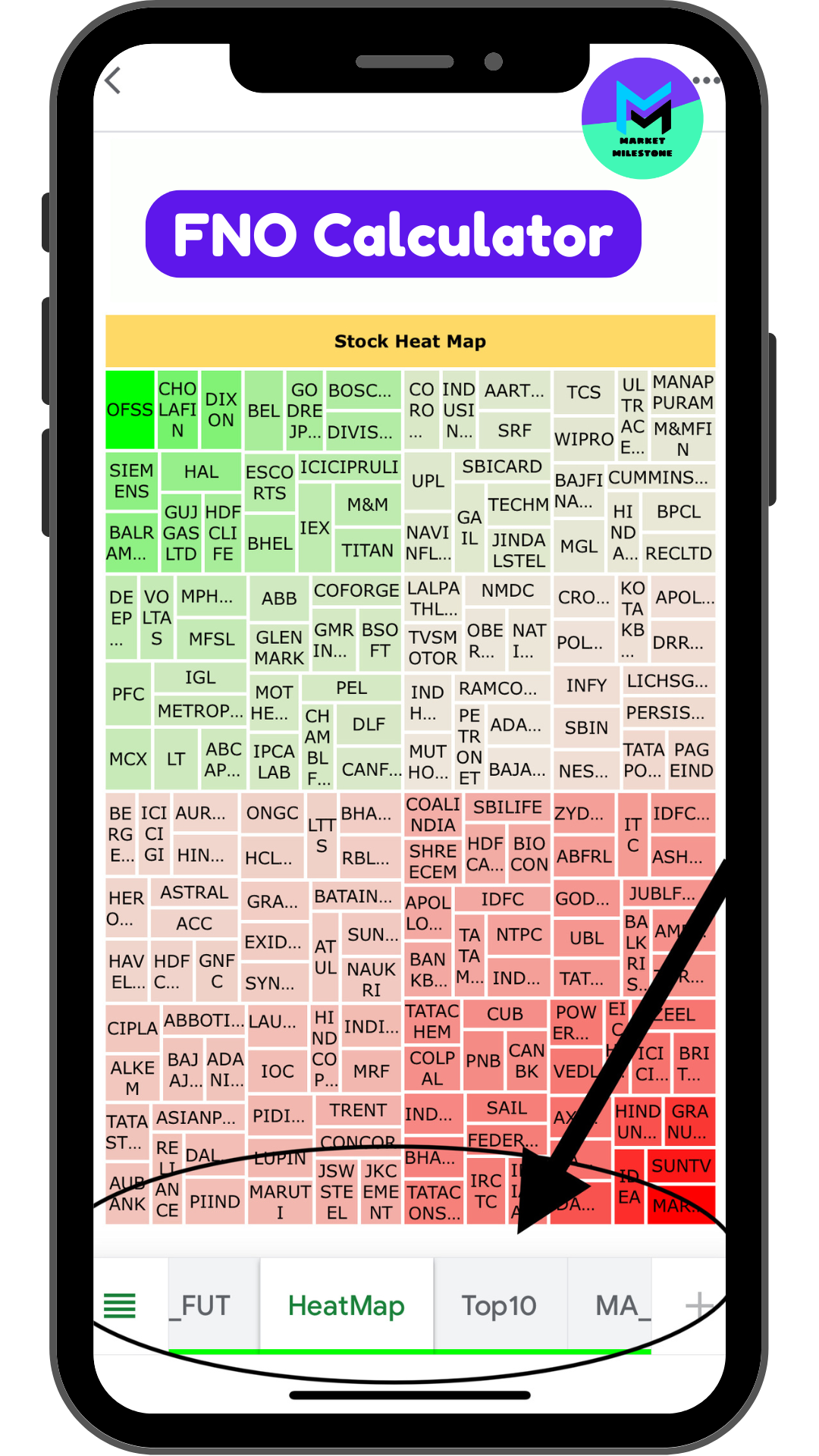

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.