Aarti Industries Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Aarti Industries Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Aarti Industries Limited (NSE: AARTIIND), a leading Indian manufacturer of specialty chemicals and pharmaceuticals, has established itself as a global player with a strong presence in agrochemicals, polymers, paints, textiles, and pharmaceuticals. Founded in 1984, the company is headquartered in Mumbai and operates state-of-the-art facilities across Gujarat and Maharashtra. Despite recent challenges, Aarti Industries’ focus on research and development (R&D), capacity expansion, and sustainable practices positions it for long-term growth. This blog explores the share price forecast for Aarti Industries for 2025, 2030, 2035, and 2050, incorporating a financial overview and estimated Compound Annual Growth Rate (CAGR) based on available data.

Financial Snapshot and Recent Performance

As of May 2, 2025, Aarti Industries’ share price is approximately ₹429.30, with a market capitalization of ₹15,562.98 crore. The company’s financial performance in the quarter ending December 2024 showed consolidated net sales of ₹1,840 crore, up 6.24% year-on-year (YoY), but net profit declined 62.9% to ₹46 crore from ₹124 crore in the same quarter of the previous year. For the fiscal year ending March 31, 2024, Aarti Industries reported total income of ₹6,380.73 crore and a net profit of ₹416.46 crore. The company’s revenue growth over the past five years has been modest at 8.86% CAGR, reflecting challenges such as raw material price volatility and competitive pressures.

Key financial metrics include a Price-to-Earnings (P/E) ratio of 36.67, a Price-to-Book (P/B) ratio of 2.89, and a dividend yield of 0.24%. Promoter holding stands at 42.24% as of March 2025, with 3.55% pledged, while Domestic Institutional Investors (DIIs) hold 19.95% and Foreign Institutional Investors (FIIs) hold 6.29%. The company’s EBITDA margin for Q3 FY25 was 13.8%, down from 15.1% in the prior year, indicating margin pressures.

Share Price Forecast and CAGR Assumptions

To forecast Aarti Industries’ share price, we consider its historical revenue CAGR (8.86%), industry trends, and analyst projections. The specialty chemicals sector is expected to grow due to increasing global demand, particularly in pharmaceuticals, agrochemicals, and sustainable chemicals. Aarti Industries’ strategic investments in R&D and capacity expansion, along with favorable government policies in India, support a positive outlook. However, risks such as raw material price fluctuations and global supply chain disruptions must be factored in.

2025 Forecast

Analysts project Aarti Industries’ share price to range between ₹520 and ₹1,200 by 2025, with a median target of ₹627. Assuming a conservative revenue CAGR of 10% (slightly above historical performance) and improved margins from capacity expansion, the share price could reach ₹600–₹700. This implies a CAGR of approximately 8–10% from the current price of ₹429.30, driven by export market growth in Europe and North America and a focus on high-value products.

2030 Forecast

By 2030, Aarti Industries is expected to benefit from global demand for specialty chemicals and sustainable solutions. Analyst estimates suggest a share price range of ₹1,600–₹2,500, with some projections as high as ₹2,065. Assuming a revenue CAGR of 10–12% and potential margin expansion to 15–17%, the share price could reach ₹2,000. This translates to a share price CAGR of ~12% from 2025, supported by R&D-driven innovation and import substitution opportunities.

2035 Forecast

Long-term projections are less certain, but Aarti Industries’ focus on sustainability and technological advancements could drive growth. Assuming a sustained revenue CAGR of 10% and stable market conditions, the share price could range between ₹3,000 and ₹4,500 by 2035. This implies a share price CAGR of ~8–10% from 2030, reflecting steady growth in the specialty chemicals and pharmaceutical sectors.

2050 Forecast

Predicting share prices for 2050 is speculative, but Aarti Industries’ strong market position and innovation focus suggest significant potential. Analyst projections estimate a range of ₹5,000–₹7,500. Assuming a conservative revenue CAGR of 8% beyond 2035, the share price could reach ₹6,500–₹7,000, implying a share price CAGR of ~5–7% from 2035. Factors such as mergers, acquisitions, and global demand for green chemicals could further boost growth.

Financial Report Summary

Income Statement (FY24):

- Revenue: ₹6,380.73 crore

- Net Profit: ₹416.46 crore

- EPS: ₹10.13 (Q3 FY25)

- EBITDA Margin: 15.02% (Q3 FY25)

Balance Sheet (as of March 31, 2024):

- Total Assets: ₹8,581 crore (as of June 2023)

- Interest Expense: 3.32% of operating revenues

- Employee Cost: 6.34% of operating revenues

Cash Flow:

- Cash from Investing Activities: ₹1,309.63 crore (YoY decrease of 1.52%)

Key Ratios:

- P/E: 36.67

- P/B: 2.89

- Dividend Yield: 0.24%

Risks and Considerations

Investors should note potential risks, including raw material price volatility, competition, and global economic slowdowns. Aarti Industries’ reliance on exports makes it vulnerable to geopolitical tensions, such as U.S. tariff concerns, which led to a 5.57% share price drop in April 2025. Additionally, the company’s high P/E ratio suggests it is trading at a premium, requiring sustained earnings growth to justify valuations.

Conclusion

Aarti Industries Ltd is well-positioned for growth in the specialty chemicals and pharmaceuticals sectors, driven by R&D, capacity expansion, and global demand. Share price forecasts indicate a CAGR of 8–12% through 2030, potentially slowing to 5–7% by 2050, with targets of ₹600–₹700 (2025), ₹1,600–₹2,500 (2030), ₹3,000–₹4,500 (2035), and ₹5,000–₹7,500 (2050). Investors should conduct thorough research, assess financial health, and consult financial advisors before investing, given the inherent risks and market volatility.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

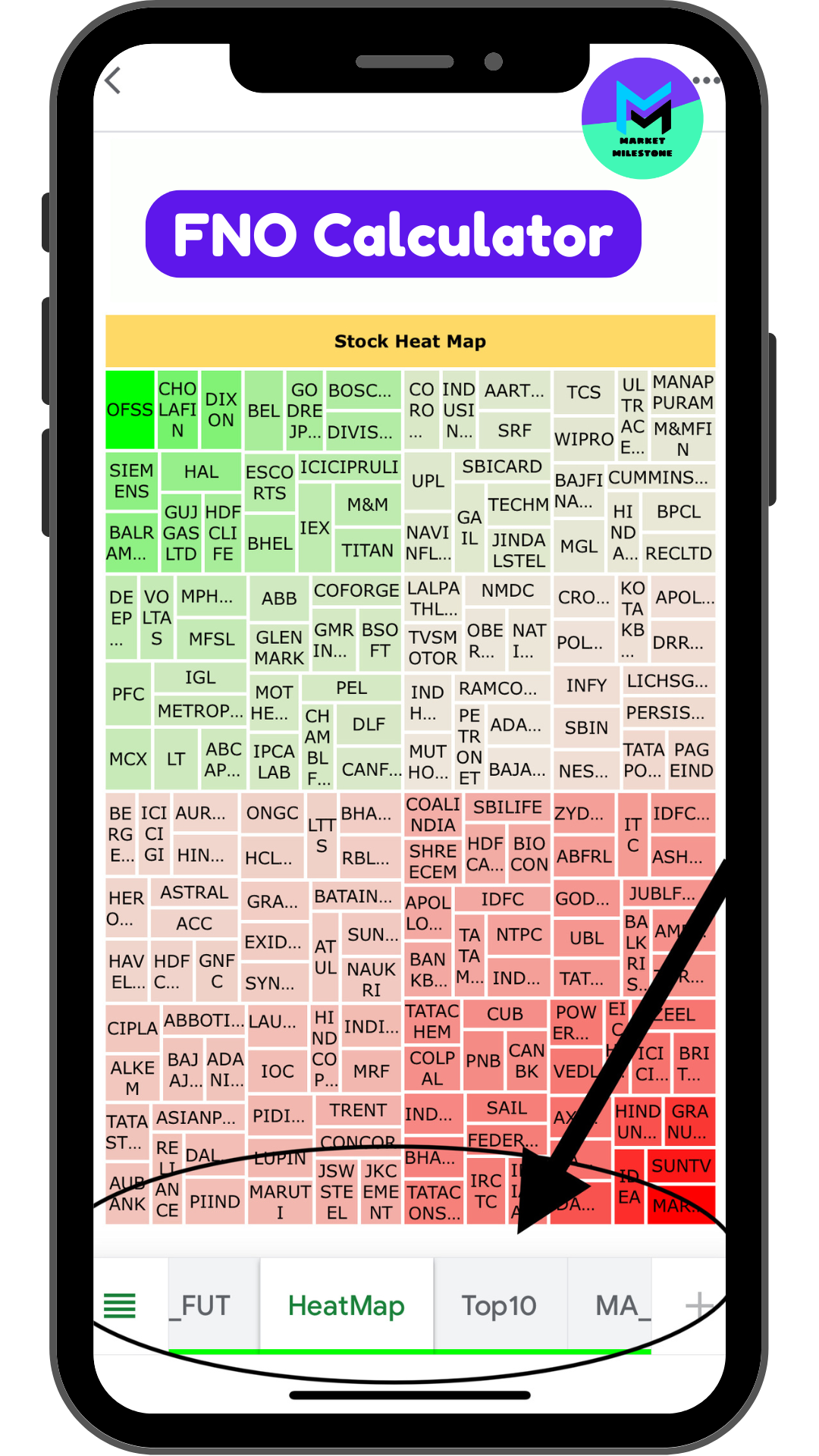

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.