Adani Transmission Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Adani Transmission Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Adani Energy Solutions Limited, previously known as Adani Transmission Limited, is a cornerstone of India’s power transmission and distribution sector. As part of the Adani Group, the company has established itself as a leader in energy infrastructure, with a robust portfolio of transmission lines, substations, and smart metering projects. Investors are keenly interested in the long-term growth potential of Adani Energy Solutions, driven by India’s increasing energy demands, government support for infrastructure, and the company’s strategic focus on renewable energy and grid modernization. This blog provides a detailed share price forecast for 2025, 2030, 2035, and 2050, along with an analysis of the company’s financial performance and estimated Compound Annual Growth Rate (CAGR).

Financial Snapshot and Recent Performance

As of April 21, 2025, Adani Energy Solutions’ share price stands at approximately ₹946.95, with a market capitalization of ₹113,755.49 crore. The company reported a strong Q3 FY25 performance, with revenue increasing 27.76% year-on-year to ₹5,830 crore and net profit surging 80% to ₹625 crore. The company’s market cap has grown to ₹112,776.42 crore, reflecting investor confidence despite a 7.31% decline in share price over the past six months and an 8.84% drop over the last year. The 52-week high and low are ₹1,348 and ₹588, respectively, indicating volatility but also potential for recovery.

Adani Energy Solutions operates in three key segments: Transmission, Generation, Transmission, and Distribution (GTD), and Smart Metering. Recent project wins, including a ₹2,800 crore transmission project in Gujarat and a ₹6,000 MW HVDC contract, underscore its growth trajectory. The company’s order book stands at ₹57,561 crore, bolstered by acquisitions like Mahan Transmission Ltd and Mundra I Transmission Ltd. Promoter holding remains strong at 69.94%, with Foreign Institutional Investors (FIIs) at 17.58% and Domestic Institutional Investors (DIIs) at 6.33% as of March 31, 2025.

Share Price Forecast

The following share price forecasts are based on historical performance, market trends, and the company’s strategic initiatives, drawing from available data and analyst projections. The estimated CAGR is derived from historical trends and expected growth in the energy sector.

2025: ₹1,200 – ₹1,400

Analysts project Adani Energy Solutions’ share price to reach ₹1,200–₹1,400 by 2025, supported by its strong order book and government-backed infrastructure projects. The company’s focus on green energy, such as the Gujarat project for Green Hydrogen and Ammonia production, aligns with India’s renewable energy goals. With a historical CAGR of 13.73% (as reported), a conservative estimate for 2025 suggests a CAGR of 12–15% from the current price of ₹946.95. This growth is driven by revenue increases (27.78% in Q3 FY25) and strategic acquisitions enhancing transmission capacity.

2030: ₹1,900 – ₹2,150

By 2030, the share price is expected to range between ₹1,900 and ₹2,150. This forecast assumes a CAGR of 10–12%, reflecting sustained profitability and expansion into new transmission projects. Adani Energy Solutions’ adoption of advanced technologies and smart metering initiatives will likely boost operational efficiency. The company’s role in India’s energy transition, coupled with global demand for efficient power transmission, supports this upward trajectory. Increased FII and DII investments (up to 17.58% and 6.33%, respectively) indicate growing institutional confidence.

2035: ₹2,980 – ₹3,370

Looking ahead to 2035, the share price could reach ₹2,980–₹3,370, implying a CAGR of 9–11% from 2030. Adani Energy Solutions’ focus on innovation, such as HVDC systems and smart grid technologies, will strengthen its market position. The company’s transmission network is expected to expand significantly, with current capacity at 25,928 circuit kilometers (cKM) and 87,186 MVA. Strategic partnerships and government policies favoring renewable energy will further drive growth, despite potential challenges like regulatory risks.

2050: ₹6,000 – ₹7,500

By 2050, Adani Energy Solutions could see its share price soar to ₹6,000–₹7,500, assuming a long-term CAGR of 7–9%. This ambitious target reflects the company’s potential to dominate the global power transmission sector. Factors include continued infrastructure development, global energy demand, and Adani’s ability to navigate market dynamics. The company’s debt levels (not explicitly detailed but noted as manageable) and profitability trends (net profit of ₹1,141.10 crore in 2024) support long-term value creation.

Financial Report Summary

- Revenue (Q3 FY25): ₹5,830 crore (27.76% YoY growth)

- Net Profit (Q3 FY25): ₹625 crore (80% YoY growth)

- Market Cap: ₹112,776.42 crore

- P/E Ratio: 51.27 (as of April 21, 2025)

- P/B Ratio: 0.19 (indicating potential undervaluation)

- ROE (5-year average): 14.33% (ranging from 8.99% to 20.1%)

- Promoter Holding: 69.94% (stable, with 0.81% pledged)

- Order Book: ₹57,561 crore

- Transmission Capacity: 25,928 cKM, 87,186 MVA

Risks and Considerations

While Adani Energy Solutions shows strong growth potential, investors should consider risks such as regulatory changes, geopolitical factors, and debt management. Fitch Ratings’ negative outlook due to US investigations highlights governance concerns, though positive market sentiment persists. The energy sector’s shift to renewables may require significant capex, potentially impacting short-term profitability.

Conclusion

Adani Energy Solutions is well-positioned for long-term growth, driven by its strategic focus on renewable energy, robust financial performance, and expansive order book. With a projected CAGR of 7–15% over the forecast period, the share price could climb from ₹1,200–₹1,400 in 2025 to ₹6,000–₹7,500 by 2050. Investors should conduct thorough research and consult financial advisors, as market uncertainties could impact these projections. Adani Energy Solutions remains a compelling opportunity in India’s evolving energy landscape.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

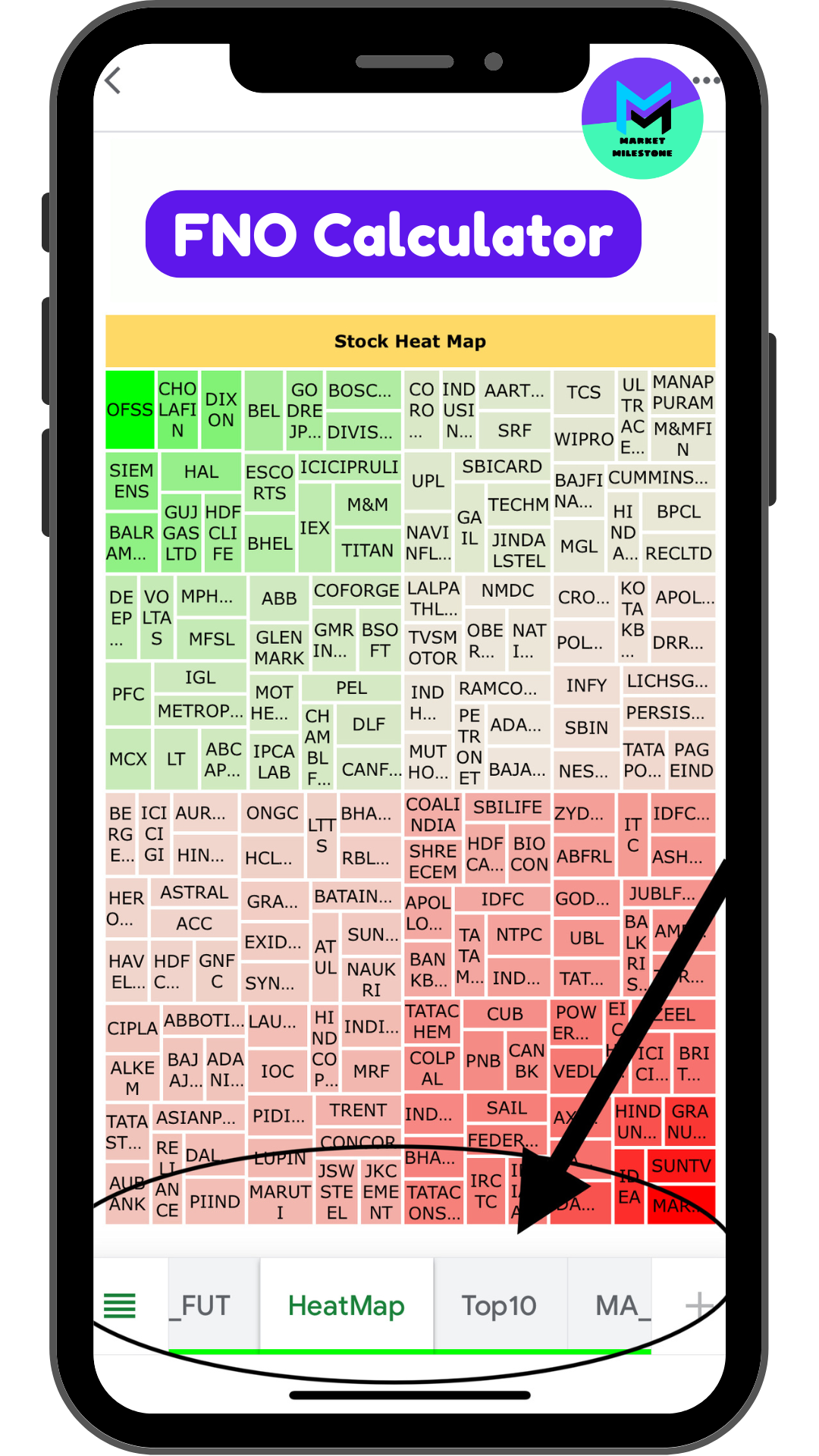

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.