Bajaj Finance Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Bajaj Finance Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Bajaj Finance Ltd. (NSE: BAJFINANCE), a leading non-banking financial company (NBFC) in India, has established itself as a powerhouse in consumer finance, SME lending, and commercial lending. Known for its robust growth, innovative products, and strong market position, the company has consistently attracted investors. This blog provides a detailed share price forecast for Bajaj Finance for the years 2025, 2030, 2035, and 2050, incorporating its historical Compound Annual Growth Rate (CAGR), recent financial performance, and market trends.

Financial Snapshot of Bajaj Finance Ltd.

As of April 21, 2025, Bajaj Finance boasts a market capitalization of approximately ₹5,72,118 crore, reflecting its significant presence in the financial sector. The company reported a consolidated revenue of ₹54,982.51 crore and a net profit of ₹14,451.17 crore for the fiscal year ending March 31, 2024. For the quarter ending December 31, 2024, it recorded a total income of ₹18,058.32 crore and a profit of ₹4,246.54 crore. Assets under management (AUM) grew by 26% year-on-year to ₹416,750 crore as of March 31, 2025, while the customer franchise expanded to 101.82 million, up from 83.64 million the previous year.

The stock’s price-to-earnings (P/E) ratio stands at 39.17, and the price-to-book (P/B) ratio is 7.38, indicating a premium valuation. The dividend yield is modest at 0.39%, with the last dividend of ₹36 per share paid in June 2024. Bajaj Finance’s historical CAGR, based on financial metrics, is approximately 19.82%, reflecting strong growth over the years.

Factors Driving Growth

Several factors underpin Bajaj Finance’s growth trajectory:

- Diversified Portfolio: The company offers a wide range of financial products, including personal loans, consumer durable loans, SME loans, and wealth management, reducing dependency on any single segment.

- Digital Innovation: Investments in technology have streamlined operations and enhanced customer experience, positioning Bajaj Finance to capitalize on India’s growing digital economy.

- Strong Brand and Market Position: As a subsidiary of Bajaj Finserv, the company benefits from high brand recognition and a vast distribution network.

- Rising Financial Inclusion: Increasing demand for credit among consumers and SMEs in India supports Bajaj Finance’s loan portfolio expansion.

However, risks such as regulatory changes, interest rate fluctuations, and competition from fintechs and banks could impact performance.

Share Price Forecast

The share price forecasts below are based on the company’s historical CAGR of 19.82%, adjusted for market trends, analyst projections, and economic factors. The current share price, as of April 21, 2025, is approximately ₹9,212.

2025: Short-Term Outlook

Analysts are optimistic about Bajaj Finance’s performance in 2025, driven by lower borrowing costs, improved asset quality, and strong AUM growth. The median target price for the next 12 months is ₹8,965.97, but some analysts, like CLSA, project a target of ₹11,000, reflecting bullish sentiment. Assuming a conservative CAGR of 15% (slightly below historical levels due to potential market volatility), the share price could reach ₹10,600–₹11,000 by the end of 2025. This aligns with projections of continued revenue growth and digital transformation.

2030: Medium-Term Growth

By 2030, Bajaj Finance is expected to solidify its dominance in the NBFC sector. Investments in technology, market expansion, and customer-centric innovations should drive sustained growth. Applying a CAGR of 15–18%, the share price could range between ₹18,000–₹20,000. This forecast assumes steady economic growth, favorable regulatory conditions, and the company’s ability to navigate competition. Analysts highlight Bajaj Finance’s diversified business model as a key factor in maintaining long-term value.

2035: Long-Term Stability

Looking further ahead to 2035, Bajaj Finance is likely to benefit from India’s expanding financial services market and increasing consumer spending. Assuming a slightly lower CAGR of 12–15% to account for market maturation and potential economic cycles, the share price could reach ₹30,000–₹35,000. Continued focus on digital infrastructure and potential international expansion could further bolster growth, though regulatory and competitive pressures may pose challenges.

2050: Vision for the Future

Predicting share prices for 2050 is inherently uncertain due to economic, technological, and regulatory variables. However, if Bajaj Finance maintains its growth trajectory and adapts to changing market dynamics, a conservative CAGR of 10–12% could push the share price to ₹60,000–₹80,000. This assumes the company leverages emerging opportunities like financial inclusion, green financing, and global market expansion while mitigating risks such as economic slowdowns or disruptive technologies.

Financial Report Summary (Based on Available Data)

- Revenue (FY 2024): ₹54,982.51 crore

- Net Profit (FY 2024): ₹14,451.17 crore

- AUM (Q4 FY 2025): ₹416,750 crore (26% YoY growth)

- Customer Base (Q4 FY 2025): 101.82 million

- EPS (Q3 FY 2025): ₹257.19

- Dividend Yield: 0.39%

- Market Cap: ₹5,72,118 crore

- P/E Ratio: 39.17

- P/B Ratio: 7.38

- Promoter Holding: 54.7% (as of March 31, 2025)

The company’s low interest coverage ratio and high valuation (trading at 6.53 times book value) suggest investors should carefully assess risk-reward dynamics.

Investment Considerations

Bajaj Finance’s strong fundamentals, diversified portfolio, and market leadership make it an attractive long-term investment. However, investors should consider:

- Upside Potential: Analyst targets and historical CAGR suggest significant growth, particularly in the medium term.

- Risks: Regulatory changes, interest rate hikes, and competition could impact profitability.

- Valuation: The stock’s premium valuation requires confidence in sustained earnings growth.

Conclusion

Bajaj Finance Ltd. is well-positioned for growth, driven by its robust business model, digital innovation, and India’s expanding financial services sector. Share price forecasts indicate potential ranges of ₹10,600–₹11,000 in 2025, ₹18,000–₹20,000 in 2030, ₹30,000–₹35,000 in 2035, and ₹60,000–₹80,000 in 2050, based on a conservative CAGR of 10–18%. While the company’s financial performance is strong, investors should remain mindful of risks and conduct thorough research before investing. Bajaj Finance’s trajectory suggests it will remain a key player in India’s financial landscape for decades to come.

Disclaimer: Share price forecasts are speculative and based on historical data, analyst projections, and market trends. Actual performance may vary due to unforeseen factors. Consult a financial advisor before making investment decisions.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

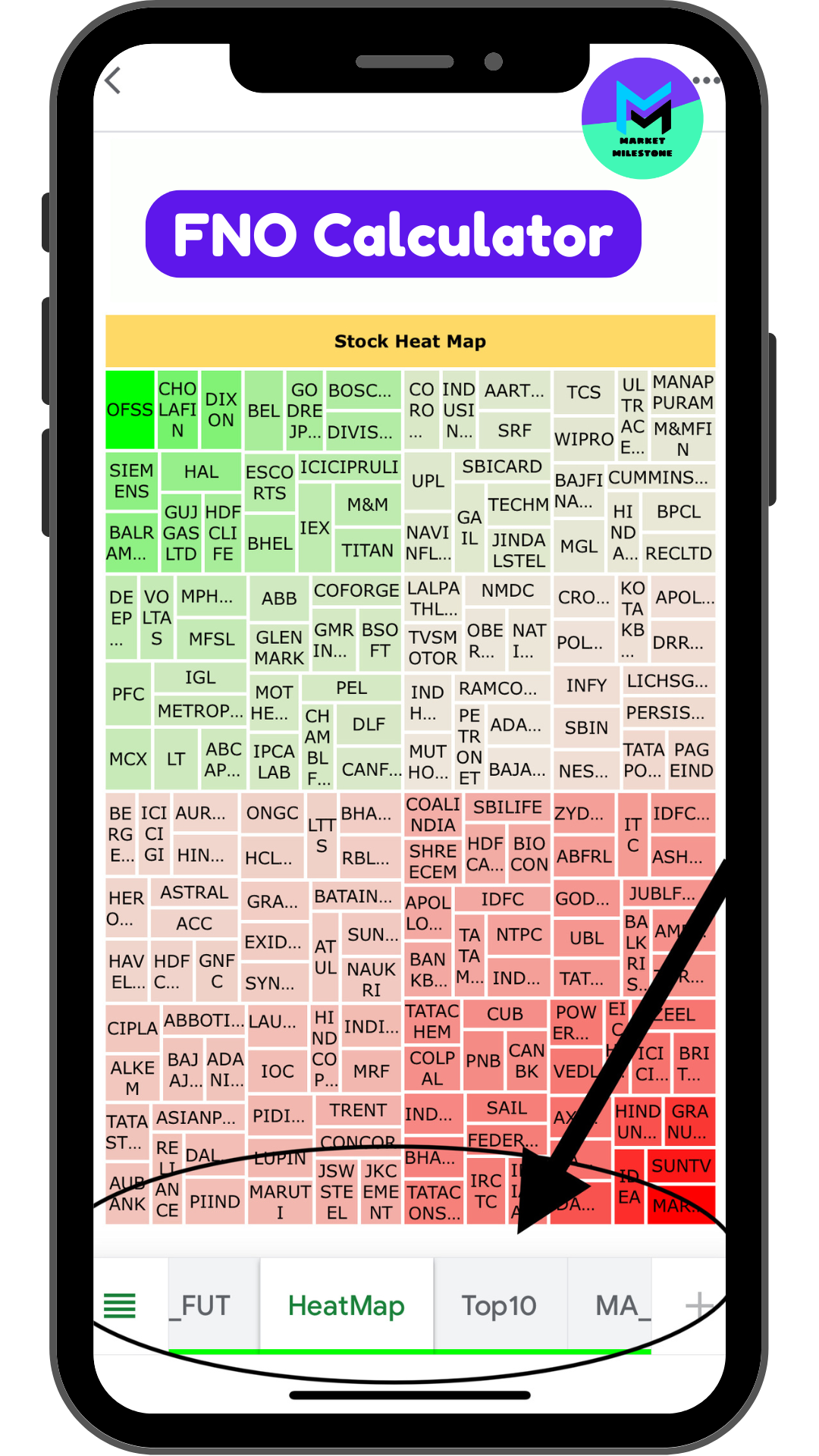

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.