CG Power share price target 2025, 2030, 2035, 2040, 2050

CG Power

CG Power Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Introduction

CG Power & Industrial Solutions Ltd has been a key player in the electrical engineering and power sector in India. Investors have shown interest in its stock performance due to its consistent financial growth. This blog provides an in-depth analysis of CG Power’s share price projection for 2025, 2030, 2035, and 2050, based on historical financial data and CAGR calculations.

Financial Overview

Current Market Position

- Current Share Price (2024): ₹616.55

- Market Capitalization: ₹94,262.48 crore

- Face Value: ₹2 per share

Historical Performance (2015-2024)

CG Power has shown consistent revenue growth, despite fluctuations in sales figures. The company’s key financial data from 2015 to 2024 is as follows:

|

Year |

Sales (₹ Crore) |

|

2015 |

5800.15 |

|

2016 |

5268.59 |

|

2017 |

5516.51 |

|

2018 |

8031.08 |

|

2019 |

7997.91 |

|

2020 |

5109.88 |

|

2021 |

2963.95 |

|

2022 |

5483.53 |

|

2023 |

6972.54 |

|

2024 |

8045.98 |

CAGR Calculation

The Compound Annual Growth Rate (CAGR) is a useful indicator to predict future growth. Using the formula:

where:

- Start Value (2015 Sales): ₹5800.15 crore

- End Value (2024 Sales): ₹8045.98 crore

- Number of Years (n): 9

The CAGR for CG Power from 2015 to 2024 is approximately 3.70%.

Share Price Forecast (2025-2050)

Based on the CAGR of 3.70%, the estimated future share prices are:

|

Year |

Projected Share Price (₹) |

|

2025 |

639.38 |

|

2030 |

766.88 |

|

2035 |

919.80 |

|

2050 |

1587.06 |

Conclusion

CG Power has demonstrated stable financial growth, and its stock is expected to appreciate gradually over time. While the projected share prices indicate steady growth, external factors such as market conditions, government policies, and technological advancements could influence actual performance. Investors should conduct thorough research and consider financial trends before making investment decisions.

Disclaimer: This analysis is based on historical data and mathematical projections. Investors should consult a financial expert before making investment decisions.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

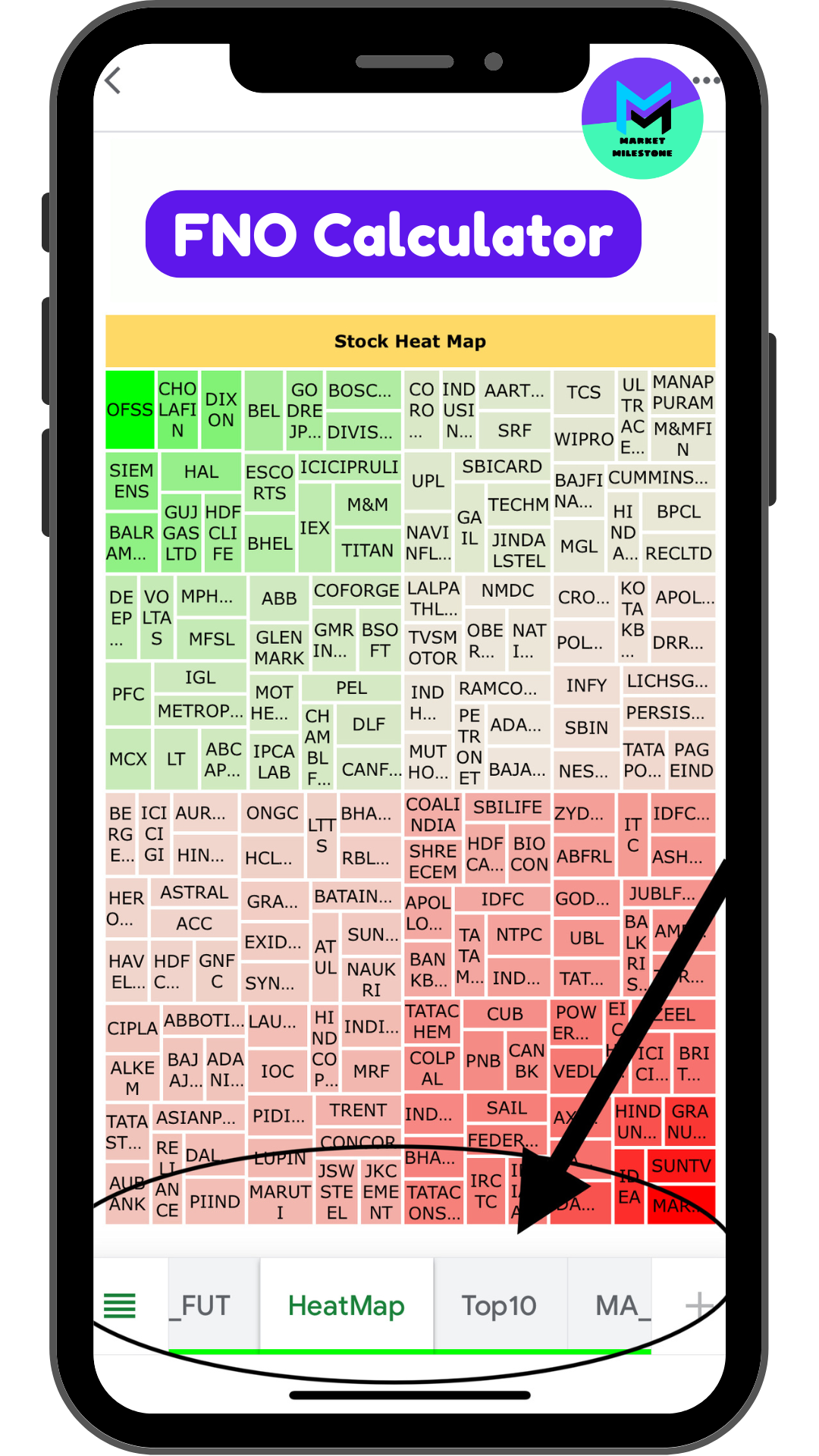

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.