HCL Technologies Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

HCL Technologies Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

HCL Technologies Ltd. (HCL Tech), a leading global IT services and consulting company, has established itself as a powerhouse in the technology sector. With a strong focus on digital transformation, artificial intelligence (AI), cloud computing, and cybersecurity, HCL Tech is well-positioned for sustained growth. This blog provides a detailed share price forecast for HCL Tech for 2025, 2030, 2035, and 2050, incorporating financial performance, market trends, and a calculated Compound Annual Growth Rate (CAGR) based on available data.

Financial Overview and Recent Performance

HCL Tech has demonstrated robust financial health, driven by its diverse service offerings and global presence across 52 countries. As of FY 2023-2024, the company reported consolidated revenue of ₹109,913 Cr, an 8% increase from the previous year, with a profit after tax (PAT) of ₹15,710 Cr, up 6%. The EBITDA stood at ₹25,693 Cr, reflecting strong operational efficiency. In Q3 FY25, HCL Tech reported revenue of $3,533 million (up 3.8% QoQ in constant currency) and an EBIT margin of 19.5%, showcasing consistent growth. The company’s market capitalization as of March 2025 was approximately ₹422,775 Cr, with a P/E ratio of 26.92 and a P/B ratio of 6.19.

HCL Tech’s strategic focus on next-generation technologies, such as AI, IoT, and cloud computing, has fueled its growth. The company’s total contract value (TCV) of new deal wins was $2.095 billion in Q3 FY25, indicating strong client demand. Additionally, HCL Tech’s partnerships, such as with Western Union and Google Cloud, enhance its capabilities in AI-driven solutions and cloud services.

CAGR Calculation and Assumptions

To forecast HCL Tech’s share price, we calculate the CAGR based on historical stock performance and projected growth. The company’s reported CAGR is approximately 9.89%. However, considering HCL Tech’s focus on high-growth areas like AI and cloud, and its consistent revenue growth of 4.5–5% YoY (FY25 guidance), we assume a slightly optimistic CAGR of 10–12% for the forecast period, factoring in market volatility and competition.

As of April 2025, HCL Tech’s share price is approximately ₹1,390.55. Using a base price of ₹1,400 for simplicity, we project future prices with a CAGR of 11% (midpoint of the range) and adjust for long-term uncertainties.

Share Price Forecast

2025: Short-Term Outlook

By 2025, HCL Tech is expected to capitalize on digital transformation trends and its AI and cloud initiatives. Analysts project a share price target of ₹1,915–₹3,545. Using a conservative CAGR of 11%, the share price could reach:

₹1,400 × (1 + 0.11)^1 = ₹1,554

A more optimistic estimate, factoring in strong deal wins and market momentum, aligns with analyst targets of around ₹2,000, driven by robust financials and strategic partnerships.

2030: Mid-Term Growth

By 2030, HCL Tech aims to dominate global IT services through innovation and strategic alliances. Analysts predict a price range of ₹4,200–₹4,982. Applying the 11% CAGR over five years:

₹1,400 × (1 + 0.11)^5 = ₹2,357

This aligns with walletinvestor.com’s forecast of ₹2,439 by 2030. Growth will likely be driven by HCL Tech’s focus on AI, cybersecurity, and expansion in emerging markets, though competition from peers like TCS and Infosys may temper gains.

2035: Long-Term Potential

By 2035, HCL Tech’s long-term strategies, including investments in co-innovation labs and acquisitions, could solidify its market leadership. Using the 11% CAGR:

₹1,400 × (1 + 0.11)^10 = ₹3,976

This assumes sustained innovation and adaptability to technological disruptions. However, economic slowdowns and currency fluctuations could pose risks.

2050: Visionary Outlook

Predicting share prices for 2050 is speculative due to technological and economic uncertainties. Assuming HCL Tech maintains its competitive edge, a 11% CAGR over 25 years yields:

₹1,400 × (1 + 0.11)^25 = ₹19,008

This optimistic scenario assumes HCL Tech leverages advancements in AI, quantum computing, and global IT demand. Analyst projections for 2050 are scarce, but a range of ₹10,000–₹15,000 is plausible if growth moderates to 8–10% CAGR in later years.

Risks and Challenges

HCL Tech faces several risks that could impact its share price:

- Competition: Aggressive pricing from competitors like TCS, Infosys, and Accenture could pressure margins.

- Economic Slowdown: Reduced IT spending in key markets like the US and Europe may affect revenue.

- Currency Fluctuations: A stronger Indian Rupee could reduce profitability from international markets.

- Dependence on Key Clients: Reliance on major clients poses risks if relationships weaken.

Investment Considerations

HCL Tech’s strong financials, diverse service portfolio, and focus on innovation make it an attractive investment. The company’s 3.74% dividend yield and consistent dividend payouts (₹18 per share in FY25, including a ₹6 special dividend) add to its appeal. However, investors should consider market volatility, with the stock declining 30% in 2025 amid tariff-induced selloffs and negative brokerage recommendations.

Conclusion

HCL Technologies Ltd. is poised for significant growth, driven by its leadership in digital transformation and emerging technologies. Share price forecasts suggest steady appreciation, with targets of ₹1,554–₹2,000 by 2025, ₹2,357–₹4,982 by 2030, ₹3,976 by 2035, and potentially ₹10,000–₹19,008 by 2050, assuming a 11% CAGR. While risks like competition and economic slowdowns exist, HCL Tech’s robust fundamentals and strategic vision make it a compelling long-term investment. Investors should conduct thorough research and consult financial advisors before investing, given the speculative nature of long-term forecasts.

Disclaimer: Share price predictions are based on current trends and analyst estimates. Actual performance may vary. Invest at your own risk.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

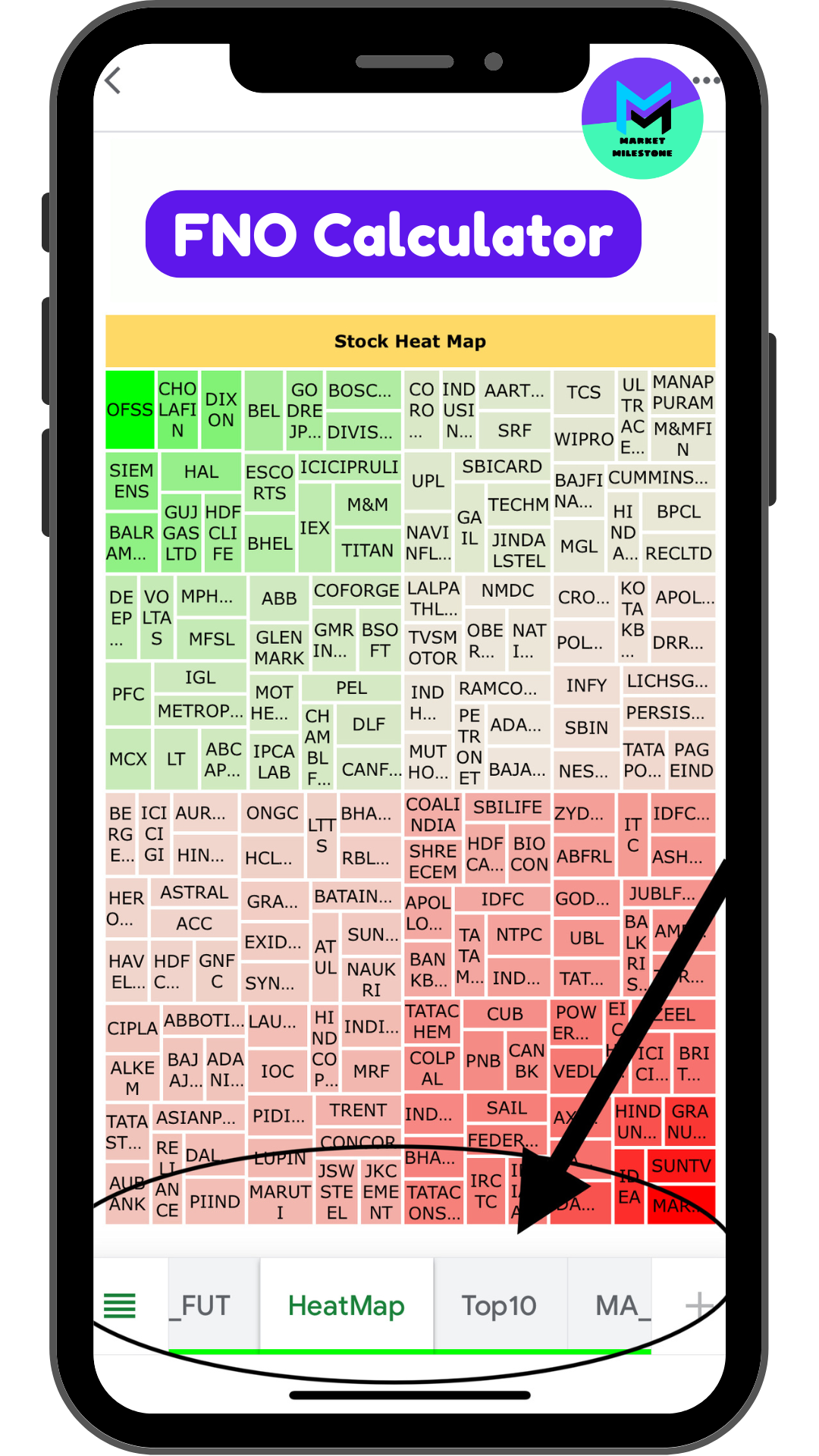

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Related posts

Infosys Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Tata Consultancy Services Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2051