ICICI Bank Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

ICICI Bank Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

ICICI Bank Ltd., one of India’s leading private sector banks, has consistently demonstrated robust financial performance, making it a favorite among investors. With a market capitalization of approximately ₹10.08 lakh crore as of April 2025, ICICI Bank is well-positioned to capitalize on India’s growing banking sector. This blog provides a detailed share price forecast for ICICI Bank for 2025, 2030, 2035, and 2050, leveraging historical data, recent financial performance, and industry trends to estimate future growth. We’ll also calculate the Compound Annual Growth Rate (CAGR) and summarize key financial insights.

Financial Performance Overview

ICICI Bank’s financials for FY25 reflect its strong growth trajectory. According to recent reports, the bank reported a 15.69% increase in net profit for Q4 FY25, reaching ₹13,502.22 crore, compared to ₹11,671.52 crore in Q4 FY24. For the full year, net profit rose 15.30% to ₹51,029.20 crore from ₹44,256.37 crore. Total operating income grew by 16.81% to ₹1,86,331.47 crore, driven by strong loan book growth and improved asset quality. The bank’s gross non-performing assets (NPA) and net NPA have declined to 2.26% and 0.45%, respectively, over the past four years, showcasing prudent risk management. Additionally, ICICI Bank’s advances grew by 16.32% year-on-year, surpassing its five-year CAGR of 12.29%, while net interest margins stood at 3.61%.

The bank’s market leadership, digital transformation initiatives like ICICI STACK and InstaBIZ, and a network of over 6,000 branches and 17,000 ATMs position it for sustained growth. ICICI Bank’s focus on retail banking, credit cards, and fintech partnerships, such as its co-lending agreement with Piramal Finance, further strengthens its outlook.

Historical CAGR and Growth Trends

ICICI Bank’s stock has delivered impressive returns over various timeframes. As of April 2025, the five-year CAGR stands at 20.16%, the three-year CAGR at 23.05%, and the one-year CAGR at 11.02%. Over the past 27 years, the stock has achieved a remarkable CAGR of 20.3%, turning an investment of ₹10,000 into ₹17.66 lakh. For forecasting purposes, we’ll assume a conservative long-term CAGR of 11.52%, as suggested by some analysts, to account for market volatility and economic cycles. However, given ICICI Bank’s strong fundamentals and India’s economic growth potential, we’ll also consider an optimistic CAGR of 15% for certain scenarios.

Share Price Forecast

2025

As of April 17, 2025, ICICI Bank’s share price is ₹1,406.70, with a 52-week high of ₹1,408.90. Analyst forecasts for 2025 vary, with price targets ranging from ₹1,441.57 to ₹1,555.99. Using a conservative CAGR of 11.52%, the share price could reach approximately ₹1,568.71 by the end of 2025. In an optimistic scenario with a 15% CAGR, the price could climb to ₹1,617.71. The median analyst target of ₹1,511.43 aligns closely with these projections, supported by expected stable net interest income growth and a proposed ₹11 per share dividend.

2030

By 2030, ICICI Bank is expected to benefit from India’s expanding economy and increasing banking penetration. Analyst estimates suggest a price range of ₹2,072.68 to ₹2,434.27. Applying the 11.52% CAGR, the share price could reach ₹2,278.54. With a 15% CAGR, the price might hit ₹2,837.30. The bank’s focus on digital banking, asset quality improvement, and growth in retail and MSME lending supports these targets.

2035

Looking further ahead, ICICI Bank’s share price could range from ₹3,135.67 to ₹3,369.81 by 2035, according to some projections. Using the 11.52% CAGR, the price could reach ₹3,308.46, while a 15% CAGR yields ₹4,977.98. India’s anticipated economic growth, coupled with ICICI Bank’s global presence in 17 countries and technological innovation, underpins this optimistic outlook.

2050

Projecting to 2050 is speculative, but ICICI Bank’s strong fundamentals and market position suggest continued growth. Assuming an 11.52% CAGR, the share price could reach ₹7,680.69. With a 15% CAGR, it might soar to ₹19,859.54. These estimates factor in long-term trends like AI integration, fintech collaborations, and global expansion, though risks like regulatory changes and competition from fintechs remain.

Key Risks and Considerations

While ICICI Bank’s outlook is promising, investors should consider risks such as economic slowdowns, regulatory changes, and competition from fintechs and peers like HDFC Bank and Axis Bank. The bank’s low interest coverage ratio and potential exposure to global economic fluctuations could also impact performance.

Conclusion

ICICI Bank Ltd. remains a compelling long-term investment, driven by its strong financials, digital innovation, and India’s economic growth. With a conservative CAGR of 11.52%, share prices could reach ₹1,568.71 by 2025, ₹2,278.54 by 2030, ₹3,308.46 by 2035, and ₹7,680.69 by 2050. An optimistic 15% CAGR suggests even higher targets. Investors should conduct thorough research and consult financial advisors, as market conditions and unforeseen risks could affect these projections. ICICI Bank’s consistent performance and strategic initiatives make it a cornerstone for portfolios targeting India’s banking sector.

Disclaimer: This forecast is for informational purposes only and not investment advice. Always perform due diligence before investing.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

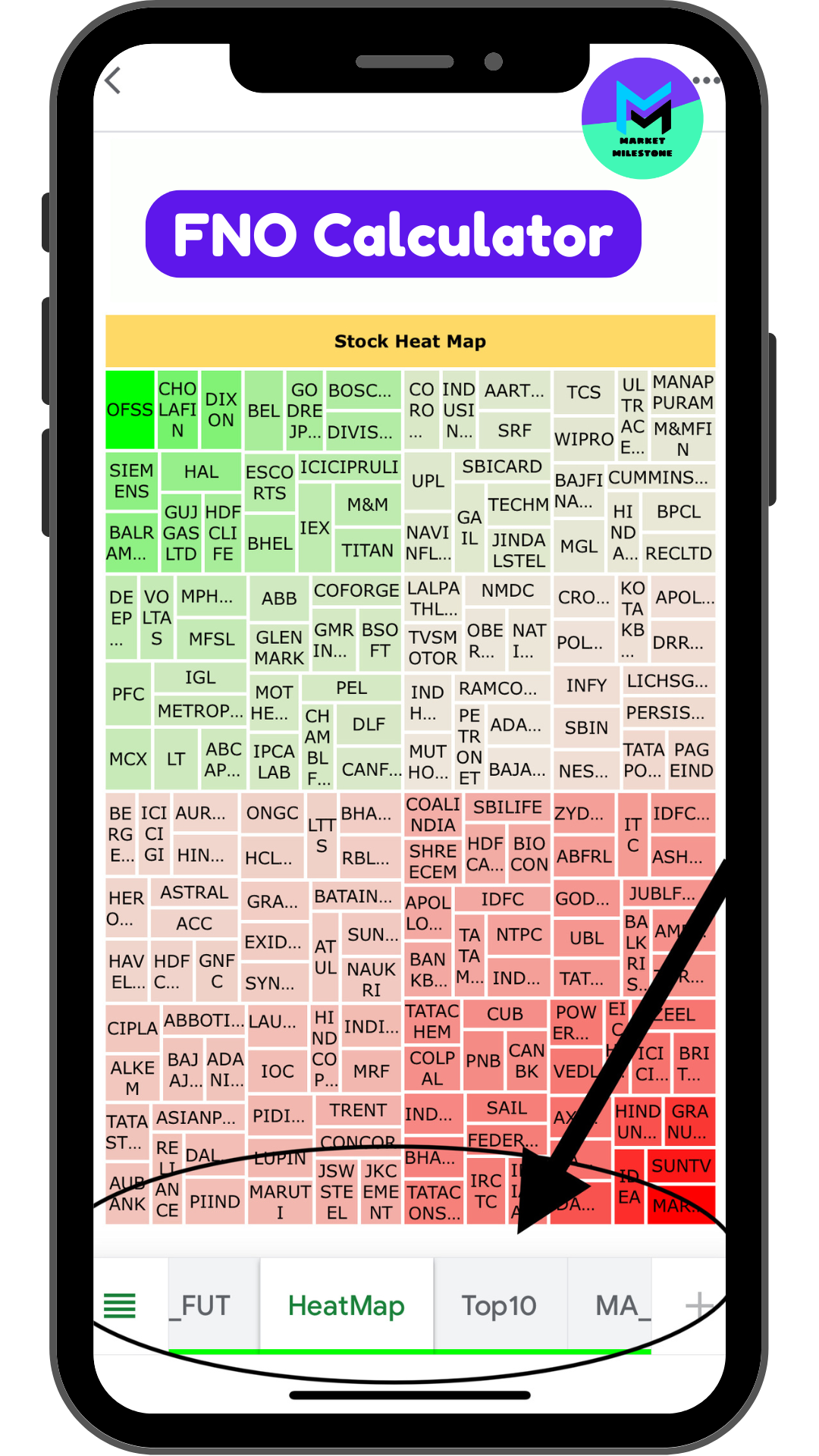

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.