Tata Consultancy Services Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2051

Tata Consultancy Services Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Tata Consultancy Services (TCS), a global leader in IT consulting and software services, is a flagship company of the Tata Group. With a market capitalization of approximately ₹11,93,770 crore as of April 2025, TCS remains a cornerstone of the Indian stock market. This blog provides a detailed forecast of TCS’s share price for 2025, 2030, 2035, and 2050, leveraging recent financial performance, industry trends, and a calculated Compound Annual Growth Rate (CAGR). We’ll also present a concise financial report based on available data to contextualize the projections.

Financial Overview of TCS (FY 2025)

TCS’s financial performance for the fiscal year ending March 31, 2025, reflects its resilience amid global economic challenges. Key highlights include:

- Revenue: ₹2,55,324 crore, up 5.99% year-on-year (YoY), driven by a 4.2% constant currency revenue growth.

- Net Profit: ₹48,553 crore, a 5.76% YoY increase, showcasing operational efficiency despite a 1.26% decline in Q4 net profit to ₹12,224 crore.

- Profit Before Tax (PBT): ₹65,331 crore, up 5.38% YoY.

- Operating Margin: 24.2% in Q4 FY25, with a net margin of 19.0%.

- Market Metrics: Price-to-Earnings (P/E) ratio of 24.48 (24% discount to peers’ median of 32.03) and Price-to-Book (P/B) ratio of 10.50 (76% premium to peers’ median of 5.98).

- CAGR (Revenue): Historical revenue CAGR of 10.06% over the past few years, though sales growth over the last five years was 10.2%, considered modest for the sector.

TCS’s debt-free status for five consecutive years and a cash conversion ratio of 125.1% in Q4 FY25 underline its financial strength. However, its stock has underperformed, delivering a -6.5% return over three years compared to the Nifty 100’s 39.01% and Nifty IT’s 1.81%.

Share Price Forecast Methodology

To forecast TCS’s share price, we assume a conservative revenue CAGR of 8% for 2025–2035, reflecting moderated growth due to global macroeconomic uncertainties, competition, and a shift toward AI-driven services. For 2035–2050, we project a 6% CAGR, accounting for market saturation and long-term stabilization. Share price growth is modeled using a combination of revenue growth, P/E multiple expansion/contraction, and analyst price targets.

Current Share Price

As of April 4, 2025, TCS’s share price is ₹3,299.40 (NSE). Analyst estimates range from ₹3,000 to ₹4,915, with an average target of ₹4,617.

2025 Share Price Forecast

For 2025, analysts predict a share price of approximately ₹3,094.73, suggesting a potential downside from the current level due to market volatility and concerns about a U.S. recession impacting IT spending. However, TCS’s resilient earnings and strategic partnerships (e.g., with Adobe and Air New Zealand) could stabilize its valuation. Assuming a P/E of 24.48 and modest revenue growth, we project a share price range of ₹3,000–₹3,500, implying a 0–6% upside.

2030 Share Price Forecast

By 2030, TCS is expected to benefit from increased adoption of cloud services, AI, and digital transformation. Applying an 8% revenue CAGR, revenue could reach approximately ₹4,08,000 crore. Assuming a P/E expansion to 26 (reflecting sector optimism), the share price could range between ₹5,500–₹6,500, aligning with analyst projections of ₹6,499.53 by 2029. This implies a CAGR of ~10% in share price from 2025.

2035 Share Price Forecast

By 2035, TCS’s revenue could approach ₹6,50,000 crore, driven by sustained demand for IT services in emerging markets and sectors like BFSI and energy. With a P/E of 25, reflecting maturity in the IT sector, the share price could range from ₹8,000–₹10,000. This assumes a continued 8% revenue CAGR and stable margins, yielding a share price CAGR of ~7–8% from 2030.

2050 Share Price Forecast

Looking to 2050, TCS’s growth will likely slow as the IT services market matures. Assuming a 6% revenue CAGR from 2035, revenue could exceed ₹15,00,000 crore. With a conservative P/E of 20, reflecting a stabilized industry, the share price could range from ₹15,000–₹20,000. This implies a long-term share price CAGR of ~5–6% from 2035, factoring in global competition and technological disruptions.

Key Growth Drivers

- Digital Transformation: TCS’s focus on AI, cloud, and automation, including partnerships with Adobe and BSNL, positions it for growth.

- Debt-Free Balance Sheet: Zero debt enhances financial flexibility for R&D and acquisitions.

- Global Presence: Strong performance in regional markets (22.5% YoY growth in Q4 FY25) supports revenue diversification.

- Dividend Strategy: Consistent dividends, including a special ₹66 per share in FY25, attract long-term investors.

Risks to Consider

- Macroeconomic Challenges: U.S. recession fears and tariff concerns could dampen IT spending.

- Competition: Rivals like Infosys and HCL Technologies may erode market share.

- Stock Underperformance: A -15.46% decline over the past year signals investor caution.

- Valuation: A high P/B ratio (10.50) suggests limited upside if growth falters.

Financial Report Summary

- Balance Sheet: Debt-free, with strong cash flows (125.1% cash conversion ratio).

- Income Statement: Revenue and profit growth of 5.99% and 5.76% YoY, respectively, with stable margins.

- Valuation Metrics: P/E of 24.48 and P/B of 10.50 indicate a premium valuation but attractive relative to peers’ P/E.

- Shareholding: Promoters hold 71.77%, with marginal changes in institutional holdings.

Conclusion

TCS remains a robust long-term investment despite near-term challenges. Its share price could reach ₹3,000–₹3,500 by 2025, ₹5,500–₹6,500 by 2030, ₹8,000–₹10,000 by 2035, and ₹15,000–₹20,000 by 2050, driven by an 8% revenue CAGR through 2035 and 6% thereafter. Investors should weigh TCS’s strong fundamentals against risks like global economic slowdowns and sector competition. Consulting a financial advisor is recommended before investing.

Disclaimer: This forecast is for informational purposes only and not a recommendation to buy or sell securities. Always conduct thorough research or consult a financial advisor.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

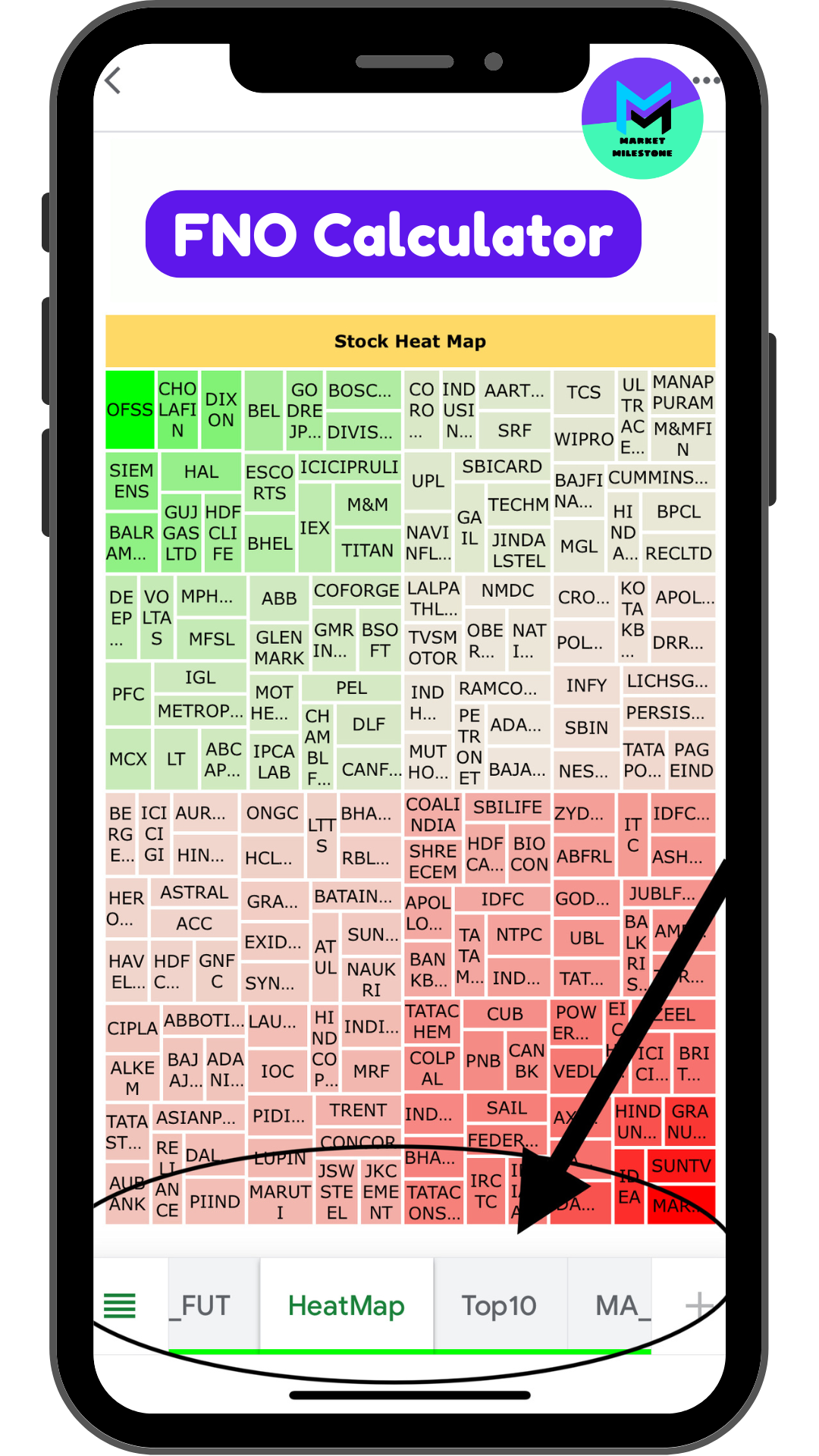

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Related posts

HCL Technologies Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Infosys Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050