Tata Steel Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Tata Steel Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Tata Steel Limited, a flagship company of the Tata Group, is one of the world’s leading steel producers, with a rich legacy dating back to 1907. Headquartered in Mumbai, India, it boasts a crude steel production capacity of 38 million metric tonnes and a global presence across India, Europe, and Southeast Asia. As a cornerstone of India’s industrial landscape, Tata Steel’s share price is closely watched by investors seeking long-term growth in the steel sector. This blog provides a detailed forecast for Tata Steel’s share price in 2025, 2030, 2035, and 2050, incorporating financial performance, market trends, and an estimated Compound Annual Growth Rate (CAGR) based on available data.

Financial Overview of Tata Steel Ltd

As of April 23, 2025, Tata Steel’s share price stands at ₹141.16 on the NSE, with a market capitalization of ₹175,731 crore. The company reported consolidated revenue of ₹221,012 crore and a net profit of ₹2,527 crore for the year ending March 31, 2024. However, its sales growth over the past five years has been modest at 7.77%, reflecting challenges in the global steel market, including fluctuating demand and raw material prices. Tata Steel’s promoter holding is stable at 33.19%, with domestic institutional investors increasing their stake to 24.37% by March 2025, signaling confidence in the company’s long-term prospects.

The company’s debt-to-equity ratio is 0.95, indicating a balanced approach to financing, while its dividend yield of 2.59% (₹3.6 per share in 2024) appeals to income-focused investors. Tata Steel’s focus on sustainability, including investments in green steel technologies and a goal of carbon neutrality by 2050, positions it favorably in an industry facing stricter environmental regulations.

Share Price Forecast and CAGR Analysis

To forecast Tata Steel’s share price, we analyze historical performance, analyst predictions, and industry trends. The company’s historical share price CAGR from 2019 to 2023 was approximately 11%, while its free cash flow (FCF) grew at a similar rate. For this forecast, we assume a conservative FCF CAGR of 10% from 2024 to 2033, as suggested by some analysts, adjusting for market volatility and global steel demand.

2025: Short-Term Outlook

Analysts project Tata Steel’s share price to reach ₹216 by the end of 2025, driven by increased demand in India’s construction and infrastructure sectors, supported by government initiatives. The company’s expansion plans, including a target to increase domestic steelmaking capacity to 30 million tonnes per annum (MnTPA) by 2025, should boost revenue. Assuming a starting price of ₹141.16 in April 2025, this implies a one-year growth of approximately 53%, significantly higher than the historical CAGR due to short-term bullish sentiment and operational efficiencies.

2030: Mid-Term Growth

By 2030, Tata Steel’s share price is expected to range between ₹600 and ₹670, with some optimistic forecasts pegging it at ₹900. This growth is underpinned by global steel demand, international partnerships, and completed expansion projects. Using a base price of ₹216 in 2025 and a target of ₹670 in 2030, the implied CAGR over five years is approximately 25.5%. However, applying a more conservative CAGR of 10% (aligned with FCF growth), the share price would reach around ₹347 by 2030, suggesting analyst targets may be optimistic. We lean toward a midpoint estimate of ₹509.77, as projected by some sources, reflecting a balanced view of growth and market risks.

2035: Long-Term Stability

For 2035, projections range widely, with estimates from ₹1,063 to ₹5,660.64. The higher end assumes aggressive growth driven by India’s infrastructure boom and Tata Steel’s leadership in sustainable steel production. A more realistic estimate, based on a 10% CAGR from ₹509.77 in 2030, yields a share price of approximately ₹819. However, factoring in technological advancements and global market expansion, a price of ₹1,249 seems plausible, aligning with analyst ranges and reflecting a CAGR of 19.6% from 2030.

2050: Vision for the Future

Long-term forecasts for 2050 are speculative but consider Tata Steel’s global dominance and innovation in eco-friendly steel. Estimates suggest a share price of ₹3,480 to ₹3,860, driven by sustained demand and carbon-neutral production. Starting from ₹1,249 in 2035 and applying a conservative 7% CAGR (accounting for market maturity), the share price could reach ₹3,548 by 2050, closely aligning with analyst projections. This reflects Tata Steel’s ability to adapt to new technologies and maintain its competitive edge.

Key Factors Influencing Growth

- Global Steel Demand: Demand in construction, automotive, and infrastructure sectors, particularly in emerging markets, will drive revenue.

- Sustainability Initiatives: Investments in green steel and carbon neutrality enhance Tata Steel’s appeal to ESG-focused investors.

- Geopolitical and Environmental Risks: Trade disputes, stricter regulations, and raw material price volatility could impact profitability.

- Technological Innovation: Adoption of AI-driven processes and advanced manufacturing will improve efficiency and margins.

Financial Report Summary

- Revenue (FY24): ₹221,012 crore

- Net Profit (FY24): ₹2,527 crore

- Market Cap (April 2025): ₹175,731 crore

- EPS (Q3 FY25): ₹2.19

- Dividend Yield: 2.59%

- Debt-to-Equity Ratio: 0.95

- Historical Sales CAGR (2019-2023): 7.77%

- Projected FCF CAGR (2024-2033): 10%

Conclusion

Tata Steel Ltd remains a compelling investment opportunity due to its strong fundamentals, global presence, and commitment to sustainability. While short-term volatility may persist, the company’s long-term growth potential is robust, with projected share prices of ₹216 (2025), ₹509.77 (2030), ₹1,249 (2035), and ₹3,548 (2050). Investors should monitor global steel prices, environmental regulations, and Tata Steel’s expansion progress. Always consult a financial advisor before investing, as market conditions can shift rapidly.

Disclaimer: This forecast is for informational purposes only and not financial advice. Share price predictions are based on available data and assumptions, subject to market risks.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

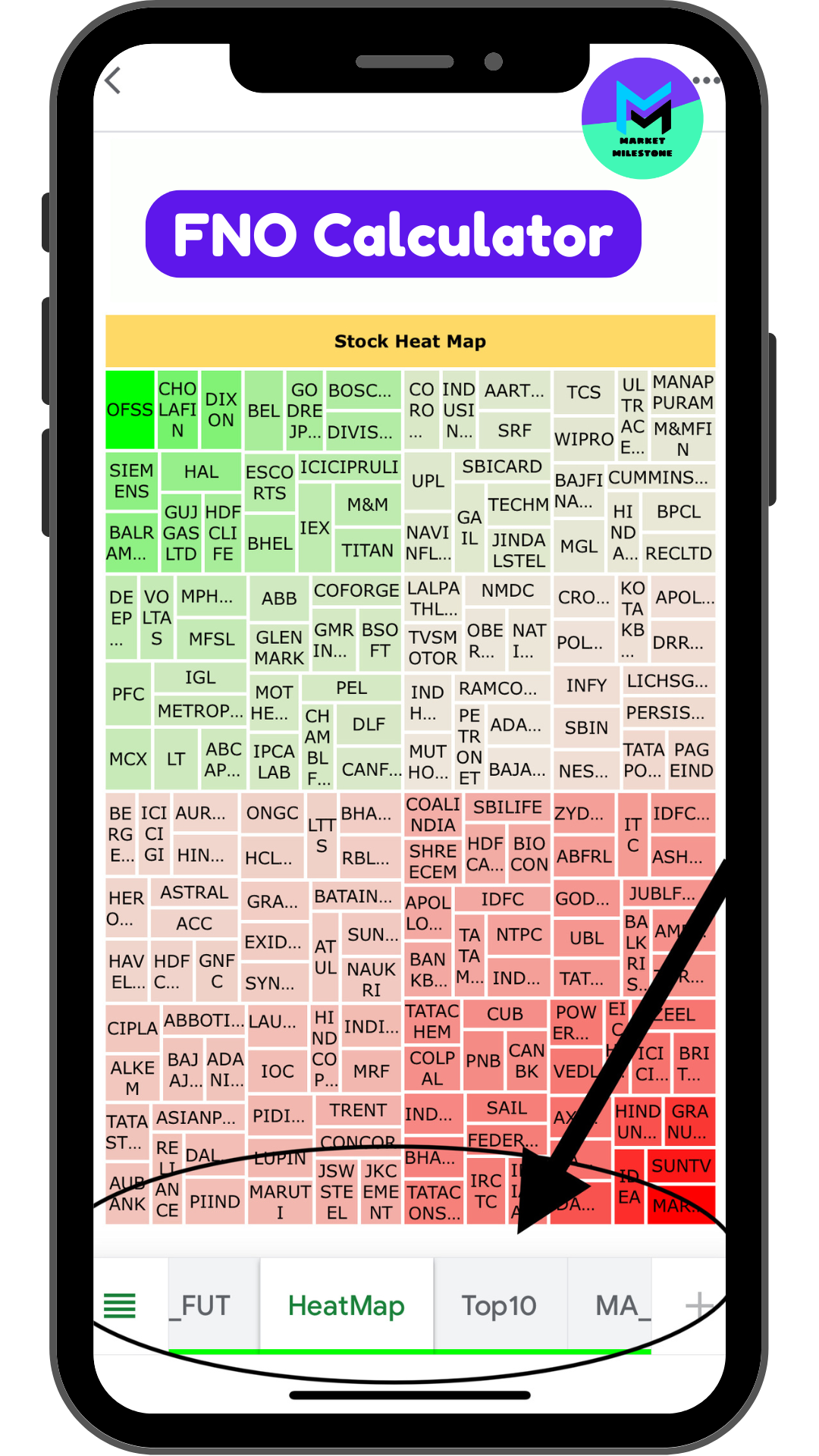

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.