Tech Mahindra Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Tech Mahindra Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Tech Mahindra Ltd., a leading Indian multinational IT services and consulting company, is a key player in the global technology landscape. As part of the Mahindra Group, it specializes in digital transformation, cloud computing, AI, cybersecurity, and telecommunications, serving industries like banking, healthcare, and manufacturing. With a market capitalization of approximately ₹138,654.88 Cr as of March 2025 and a strong global presence, Tech Mahindra is poised for growth. This blog explores its share price forecast for 2025, 2030, 2035, and 2050, incorporating a financial overview and estimated Compound Annual Growth Rate (CAGR) based on available data.

Financial Overview

As of December 2024, Tech Mahindra’s financials reflect both strengths and challenges:

- Revenue: ₹52,476 Cr, with a modest 8.40% growth over the past five years.

- Profit: ₹3,775 Cr, but profit growth has been negative at -5.91% over three years.

- Market Cap: ₹138,654.88 Cr, up 13.9% in the last year.

- Dividend Yield: 2.55% (₹50 per share), reflecting a shareholder-friendly approach.

- Debt: Virtually no debt burden, with a strong cash conversion ratio of 108.59.

- Earnings Per Share (EPS): ₹38.27 for Q4 2024.

- Shareholding: Promoters hold 35.0%, FIIs 24.19%, and DIIs 30.62%.

- Contingent Liabilities: ₹10,443.20 Cr, a potential risk.

Recent performance shows a revenue decline of 0.7% QoQ in constant currency terms, driven by challenges in the hi-tech segment. However, partnerships with ServiceNow, Google Cloud, and NVIDIA, alongside innovations like the AI-driven Altavec™ platform, signal robust growth potential in AI, 5G, and cloud services.

Share Price Trends and Analyst Forecasts

As of March 2025, Tech Mahindra’s share price is approximately ₹1,423.90, down from a 52-week high of ₹1,807.70. Analysts remain cautiously optimistic:

- 2025: Median target of ₹1,632.46 (range: ₹1,050–₹2,000) by 39 analysts, with some projections as high as ₹1,900 by Motilal Oswal.

- 2026: Targets range from ₹1,500 to ₹2,431.47, averaging around ₹2,005.91.

- 2030: Forecasts vary widely, with estimates from ₹2,530 to ₹3,000, averaging ₹2,569.67.

- Longer-term projections (2035–2050) are speculative but suggest significant upside, with some analysts predicting ₹9,600 by 2035 and up to ₹15,000 by 2050, driven by technological advancements.

CAGR Estimation

To estimate the CAGR for Tech Mahindra’s share price, we use the formula:

Assumptions:

- Current share price (2025): ₹1,423.90.

- Forecasted prices: ₹1,900 (2025), ₹2,569.67 (2030), ₹9,600 (2035), and ₹15,000 (2050).

- Historical revenue CAGR (5 years): 8.40%.

- Profit growth has been negative, so we assume a conservative share price growth aligned with industry trends (IT sector CAGR ~8–12%).

Calculations:

- 2025 (1 year): From ₹1,423.90 to ₹1,900.

(This is optimistic due to short-term bullish sentiment.)

- 2030 (5 years): From ₹1,423.90 to ₹2,569.67.

- 2035 (10 years): From ₹1,423.90 to ₹9,600.

- 2050 (25 years): From ₹1,423.90 to ₹15,000.

These CAGRs reflect short-term optimism (2025), moderate growth (2030), and long-term potential driven by AI, 5G, and global IT spending (2035–2050). The 9.9% CAGR for 2050 aligns with the IT industry’s historical growth, adjusted for market saturation risks.

Growth Drivers

- Technological Innovation: Investments in AI, 6G, blockchain, and cloud computing position Tech Mahindra as a leader in digital transformation.

- Strategic Partnerships: Collaborations with Google Cloud, NVIDIA, and ServiceNow enhance service offerings.

- Global Presence: Operating in 90 countries with 1,262 active clients, including Fortune 500 companies, ensures diversified revenue.

- 5G and Telecom: With 40% of revenue from communications, Tech Mahindra benefits from 5G adoption.

Risks and Challenges

- Market Dependence: Heavy reliance on U.S. and Europe markets exposes it to geopolitical and economic risks.

- Talent Retention: Competition for skilled professionals in AI and cybersecurity could impact growth.

- Regulatory Compliance: Stricter global data privacy laws may increase costs.

- Market Saturation: By 2030, traditional IT services may face growth constraints.

Share Price Forecast

- 2025: ₹1,700–₹2,400, driven by AI demand and 5G expansion.

- 2030: ₹2,500–₹3,000, supported by diversified services and global IT spending.

- 2035: ₹9,000–₹9,600, fueled by advancements in AI, 6G, and cloud computing.

- 2050: ₹12,000–₹15,000, assuming sustained innovation and market leadership, though long-term forecasts are speculative.

Conclusion

Tech Mahindra’s share price outlook is promising, with a projected CAGR of 12.5% by 2030 and 9.9% by 2050. Its focus on emerging technologies, strong financials, and global reach make it a compelling investment. However, investors should monitor risks like market dependence and talent retention. Always consult a financial advisor before investing, as market conditions and company performance can shift.

Disclaimer: These forecasts are based on analyst predictions and historical data, not guarantees. Verify information and conduct thorough research before investing.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

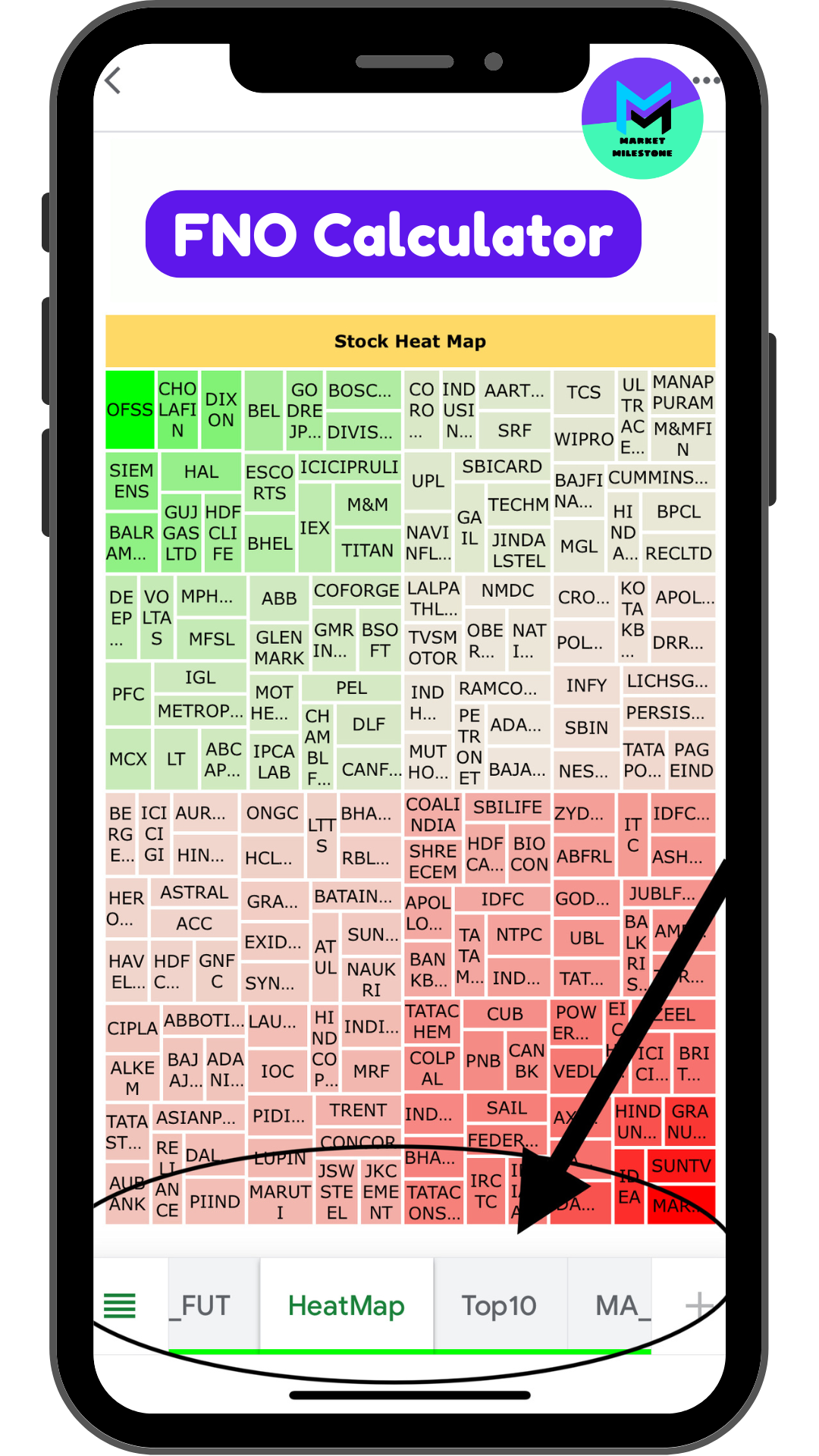

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Related posts

Infosys Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Tata Consultancy Services Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2051