Titan Company Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Titan Company Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Titan Company Ltd., a flagship of the Tata Group, is a leading Indian consumer goods company renowned for its dominance in jewellery, watches, and eyewear. With brands like Tanishq, Fastrack, and Titan EyePlus, the company has built a robust market presence, driven by innovation, quality, and a strong retail network. As investors look to the future, understanding Titan’s share price trajectory and financial performance is crucial. This blog provides a detailed forecast for Titan’s share price in 2025, 2030, 2035, and 2050, leveraging historical Compound Annual Growth Rates (CAGR) and recent financial data to project future growth.

Financial Snapshot and Growth Drivers

Titan has demonstrated impressive financial performance, with a market capitalization of ₹2,96,290 crore as of April 2025. For the fiscal year 2024, the company reported revenue of ₹58,034 crore and a net profit of ₹3,237 crore. Over the past three years, Titan achieved a sales growth CAGR of 33.2% and a profit growth CAGR of 26.8%. The stock’s historical CAGR provides insight into its potential: 29% over 10 years, 49% over 5 years, 38% over 3 years, and 66% over 1 year. However, recent data indicates a 1-year decline of -17.71%, reflecting market volatility and high valuations.

Key growth drivers include rising discretionary incomes in India, a shift from unorganized to organized jewellery markets, and expansion into new product categories and international markets like the Middle East and North America. Titan’s jewellery segment, contributing over 80% of revenue, benefits from strong festive demand, with a 26% year-on-year growth in Q3 FY25. The company’s retail network expanded to 3,240 stores by Q3 FY25, reinforcing its market reach.

Share Price Forecast Methodology

To forecast Titan’s share price, we use a conservative CAGR of 15%, aligning with the company’s 10-year sales CAGR and management’s target of 15-20% revenue growth over the next few years. This accounts for potential economic uncertainties, rising gold prices, and competitive pressures. The current share price, as of April 22, 2025, is approximately ₹3,337.40. We apply the formula for future value:

Future Value = Present Value × (1 + CAGR)^n, where n is the number of years.

2025 Share Price Forecast

For 2025, assuming a 1-year horizon from April 2025, we project:

- Share Price: ₹3,337.40 × (1 + 0.15)^1 = ₹3,838.01

- Range: ₹3,700–₹4,100, factoring in market volatility and analyst targets (e.g., Goldman Sachs at ₹3,900, Motilal Oswal at ₹4,000).

Analysts remain bullish, citing Titan’s strong jewellery EBIT growth (projected at 20% for FY26) and robust festive demand. However, high valuations (P/E ratio of 80.54) and potential slowdowns in discretionary spending could cap upside.

2030 Share Price Forecast

By 2030 (5 years from April 2025), we project:

- Share Price: ₹3,337.40 × (1 + 0.15)^5 = ₹6,709.71

- Range: ₹6,000–₹7,500, considering macroeconomic factors and international expansion.

Titan’s focus on premiumization, digital initiatives, and eyewear growth will drive revenue. Analysts predict a stock price of ₹6,106.19 by 2030, aligning with our estimate. Risks include rising competition and fluctuating gold prices, though Titan’s debt-free balance sheet provides stability.

2035 Share Price Forecast

For 2035 (10 years from April 2025), we estimate:

- Share Price: ₹3,337.40 × (1 + 0.15)^10 = ₹13,495.83

- Range: ₹10,500–₹14,500, based on forecasts suggesting ₹12,450.40 as a maximum target.

Titan’s long-term growth will hinge on capturing the growing Indian middle class and leveraging its brand equity. The company’s ability to innovate in watches (e.g., Fastrack’s youth appeal) and expand globally will be critical. Economic uncertainties and shifting consumer preferences remain challenges.

2050 Share Price Forecast

By 2050 (25 years from April 2025), we project:

- Share Price: ₹3,337.40 × (1 + 0.15)^25 = ₹109,805.47

- Range: ₹80,000–₹120,000, reflecting long-term optimism tempered by market risks.

This ambitious forecast assumes Titan maintains its market leadership and adapts to technological and consumer trends. However, such long-term projections are speculative, as geopolitical, environmental, and economic factors could significantly alter outcomes.

Financial Report Highlights

- Revenue (FY24): ₹58,034 crore, up 24.95% YoY in Q3 FY25.

- Net Profit (Q3 FY25): ₹990 crore, down 4.8% YoY due to higher costs.

- Market Cap (April 2025): ₹2,96,290 crore.

- P/E Ratio: 80.54, indicating premium valuation.

- P/B Ratio: 29.98, trading at 30.4 times book value.

- Dividend Yield: 0.35%, with an 1100% dividend (₹11 per share) in FY24.

- Shareholding: Promoters (52.9%), FIIs (17.82%), DIIs (11.9%), Public (17.38%).

Risks and Considerations

Despite its strong fundamentals, Titan faces risks:

- Market Volatility: A 52-week low of ₹2,925 in March 2025 reflects tariff concerns and gold price fluctuations.

- High Valuations: A P/E of 80.54 suggests the stock may be overpriced, limiting short-term gains.

- Competition: Emerging startups and global luxury brands could challenge Titan’s market share.

- Economic Slowdowns: Reduced consumer spending could impact discretionary purchases.

Investors should consult financial advisors, assess risk tolerance, and monitor quarterly results (e.g., Q4 FY25 earnings on May 8, 2025) before investing.

Conclusion

Titan Company Ltd. remains a compelling long-term investment, driven by its strong brand portfolio, financial stability, and growth initiatives. Our share price forecasts—₹3,838 in 2025, ₹6,710 in 2030, ₹13,496 in 2035, and ₹109,805 in 2050—reflect a conservative 15% CAGR, grounded in historical performance and market trends. While short-term volatility and high valuations warrant caution, Titan’s leadership in jewellery and expanding footprint make it a wealth-creating opportunity for patient investors.

Disclaimer: Stock price predictions are speculative and subject to market risks. Conduct thorough research and seek professional advice before investing.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

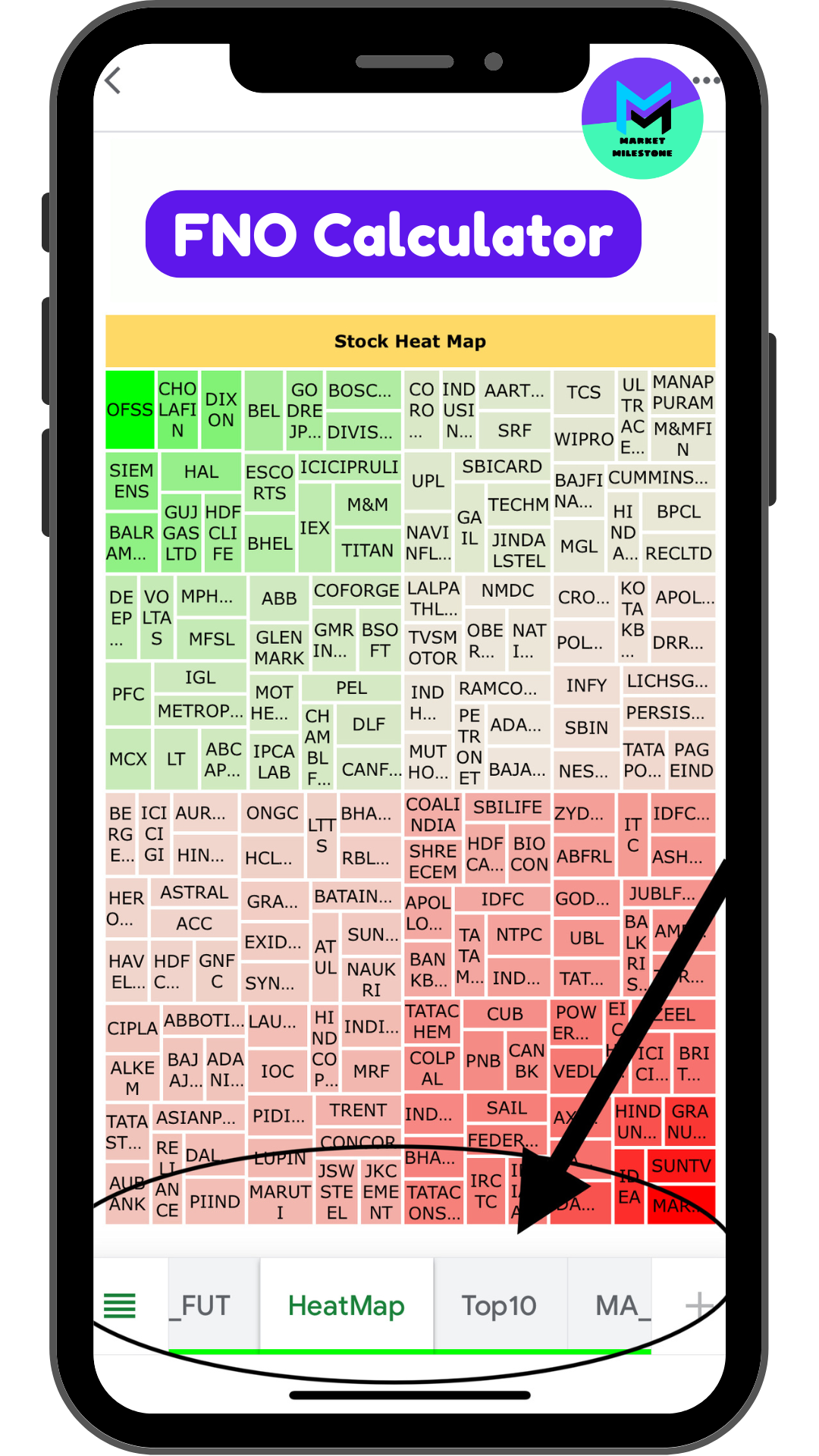

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.