Trent Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Trent Ltd Share Price Forecast: 2025, 2030, 2035, and 2050 – A Comprehensive Analysis

Trent Limited, a leading retail arm of the Tata Group, has emerged as a powerhouse in India’s fashion and lifestyle retail sector. With brands like Westside, Zudio, and Star Bazaar, Trent is capitalizing on India’s growing retail market. This blog delves into Trent Ltd’s share price forecast for 2025, 2030, 2035, and 2050, leveraging financial data, historical performance, and market trends to project future growth. We’ll also analyze the company’s Compound Annual Growth Rate (CAGR) and provide a concise financial overview.

Trent Ltd: Company Overview

Trent Ltd operates over 1,000 stores, including 248 Westside outlets, 765 Zudio stores, and 30 other lifestyle formats as of March 2025. The company reported a robust 39% revenue growth in FY25, reaching ₹17,624 crore, with a Q4 FY25 revenue of ₹4,334 crore (up 28% YoY). Trent’s net profit for Q3 FY24-25 surged 32.83% to ₹497.25 crore, reflecting strong operational efficiency. With a market capitalization of ₹1,88,426 crore and a 5-year revenue CAGR of 36%, Trent is a compelling investment option.

Financial Performance Snapshot

- Revenue (FY25): ₹17,624 crore (39% YoY growth)

- Q4 FY25 Revenue: ₹4,334 crore (28% YoY growth)

- Net Profit (Q3 FY24-25): ₹497.25 crore (32.83% YoY growth)

- Market Cap: ₹1,88,426 crore

- P/E Ratio: 91.41 (industry premium: 190% above peers)

- P/B Ratio: 34.31 (484% premium to peers)

- Dividend Yield: 0.06% (₹3.2 per share in 2024)

- Promoter Holding: 37.01% (stable)

- 5-Year Revenue CAGR: 36%

Despite a 32% YTD stock decline in 2025 and a 42% drop over six months, analysts remain bullish, citing Trent’s aggressive expansion and leadership in value retail. Brokerages like Goldman Sachs (target: ₹8,120) and Macquarie (target: ₹7,000) highlight Zudio’s growth and a projected 45% sales CAGR for FY23-25.

Share Price Forecast Methodology

Our share price projections are based on:

- Historical CAGR: Trent’s 5-year revenue CAGR of 36% and stock price CAGR of 47.8%.

- Analyst Targets: Consensus from 21 analysts, with a 12-month median target of ₹6,084.29 and a high of ₹8,120.

- Market Trends: India’s retail sector is expected to grow at a 10% CAGR over the next five years, driven by urbanization and rising disposable incomes.

- Technical Analysis: Current “Strong Buy” signal based on moving averages.

We assume a conservative stock price CAGR of 20-25% for 2025-2030, tapering to 15-20% for 2030-2050, reflecting market maturity and competition.

Share Price Forecast

2025

- Estimated Range: ₹7,272 – ₹8,228

- Rationale: Analysts project a mid-year target of ₹7,804, reaching ₹8,228 by year-end, driven by Zudio’s expansion (132 new stores in Q4 FY25) and a 28% revenue growth trajectory. Despite a Q4 slowdown, Trent’s strong fundamentals and analyst backing (e.g., Goldman Sachs’ ₹8,120 target) support a bullish outlook. The stock closed at ₹5,335.5 on April 7, 2025, suggesting a potential 36-54% upside.

2030

- Estimated Range: ₹12,966 – ₹14,057

- Rationale: Assuming a 20% CAGR from 2025, Trent’s share price could reach ₹14,057 by 2030. This aligns with projections of ₹12,793-₹14,057, fueled by a 10% retail sector CAGR and Trent’s market share gains in value fashion. Zudio’s international expansion (e.g., UAE stores) and operational efficiencies will drive growth.

2035

- Estimated Range: ₹21,075 – ₹23,226

- Rationale: With a 15% CAGR from 2030, Trent’s share price could hit ₹23,226 by 2035. Continued store additions, digital integration, and brand loyalty will sustain growth. However, competition and market saturation may temper the CAGR compared to earlier years.

2050

- Estimated Range: ₹90,502 – ₹98,117

- Rationale: Projecting a 15% CAGR from 2035, Trent’s share price could reach ₹98,117 by 2050. This optimistic forecast assumes Trent maintains its leadership in retail, leverages technology (e.g., e-commerce, AI-driven analytics), and navigates macroeconomic challenges. Long-term investors could see a 165% return from 2025 levels, as suggested by historical trends.

Risks to Consider

- Valuation Concerns: Trent’s P/E (91.41) and P/B (34.31) ratios are significantly above industry medians, indicating potential overvaluation.

- Revenue Slowdown: Q4 FY25 growth (28%) lagged the 5-year CAGR (36%), raising concerns about demand softness and discounting.

- Market Volatility: A 19% share price drop post-Q4 update reflects investor sensitivity to growth metrics.

- Competition: Rivals like Reliance Retail and Aditya Birla Fashion may challenge Trent’s market share.

Investment Outlook

Trent Ltd remains a strong long-term investment due to its robust brand portfolio, aggressive expansion, and alignment with India’s retail growth story. While short-term volatility and high valuations warrant caution, the company’s 36% revenue CAGR, 47.8% stock price CAGR, and analyst optimism (average target: ₹6,522) underscore its potential.

For investors, a phased investment approach with a 5-10 year horizon could maximize returns. Monitor quarterly results (next report: April 23, 2025) and store expansion updates for entry points.

Conclusion

Trent Ltd’s share price is poised for significant growth, with projected targets of ₹8,228 (2025), ₹14,057 (2030), ₹23,226 (2035), and ₹98,117 (2050). Backed by a 36% revenue CAGR, strategic expansions, and a bullish retail sector outlook, Trent is a standout in India’s retail landscape. However, investors should weigh valuation risks and market dynamics. For the latest updates, check NSE/BSE listings or trusted platforms like Moneycontrol and Economic Times.

Disclaimer: Stock forecasts are speculative and subject to market risks. Consult a financial advisor before investing.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

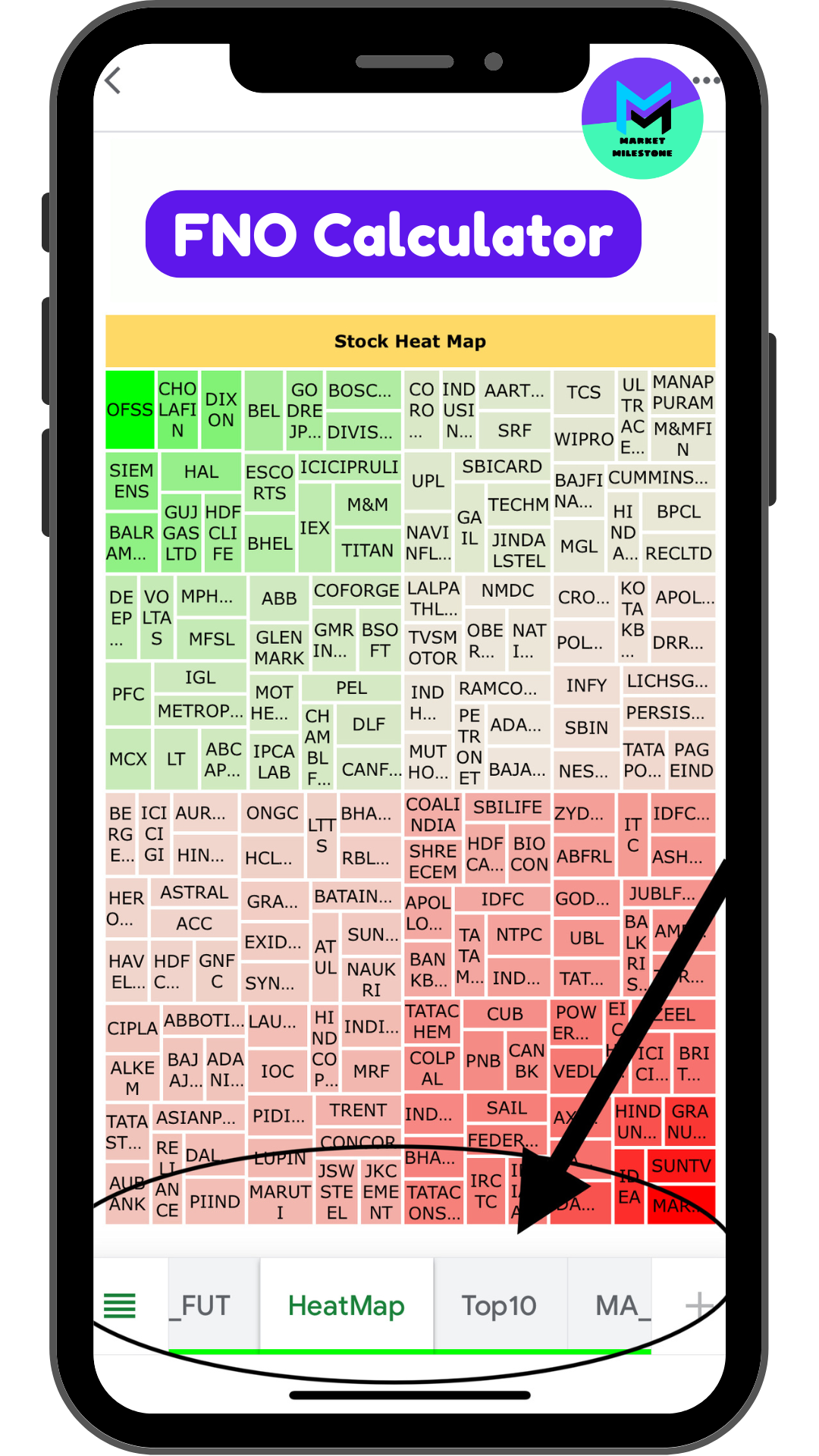

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.