Vedanta Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Vedanta Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Vedanta Limited, a leading global natural resources conglomerate, has established itself as a powerhouse in sectors like zinc, aluminum, copper, iron ore, oil & gas, and power. With a diversified portfolio and strategic expansions, Vedanta Ltd is a favorite among investors seeking long-term growth. In this blog, we provide an Vedanta Ltd share price forecast for 2025, 2030, 2035, and 2050, leveraging the latest financial data and market trends to estimate the Compound Annual Growth Rate (CAGR) and prepare a concise financial report.

Vedanta Ltd: Company Overview

Founded in 1976 by Anil Agarwal, Vedanta Ltd is headquartered in Mumbai, India, and operates across India, Africa, and other regions. The company’s operations span zinc-lead-silver, aluminum, copper, iron ore, steel, power, oil & gas, and emerging sectors like semiconductors. With a market capitalization of ₹161,499.02 Cr as of April 22, 2025, and a robust dividend yield of 7.37%, Vedanta remains a compelling investment choice. Its commitment to sustainability, including a $5 billion pledge to achieve net-zero carbon emissions by 2050, further enhances its appeal.

Financial Report: Vedanta Ltd’s Performance

Vedanta Ltd has shown resilience amid global commodity price volatility. Here’s a snapshot of its financial performance based on the latest data:

- Revenue (FY 2024): ₹146,277 Cr (consolidated), reflecting strong operational scale.

- Net Profit (FY 2024): ₹4,239 Cr, with a quarterly profit of ₹3,547 Cr for Q4 FY24.

- EBITDA (Q3 FY24): ₹8,677 Cr, up 22% YoY, showcasing operational efficiency.

- Market Cap (April 2025): ₹161,499.02 Cr, with a share price of ₹413.05 (NSE, April 22, 2025).

- P/E Ratio: 12.51, indicating undervaluation compared to the sector P/E of 16.34.

- Dividend Yield: 7.37%, with a recent dividend of ₹8.5 paid on December 24, 2024.

- CAGR (Historical): 13.04% (based on long-term stock performance).

Despite challenges like a high promoter pledge (99.99% of 56.38% stake) and exposure to commodity price fluctuations, Vedanta’s strategic debt restructuring ($3.2 billion in Q3 FY24) and production growth (e.g., 4% YoY increase in zinc production) signal strong fundamentals.

Vedanta Ltd Share Price Forecast

Using the historical CAGR of 13.04% and factoring in analyst projections, industry trends, and Vedanta’s expansion plans (e.g., $20 billion investment and demerger into four entities), we estimate future share prices. Analyst targets for 2025 range from ₹380 to ₹583, with a median of ₹526.15. Long-term forecasts are based on sustained growth, commodity demand, and operational efficiencies.

Share Price Forecast Methodology

- Base Price (April 2025): ₹413.05

- CAGR Assumption: 10–12% (adjusted for conservative growth, considering commodity volatility and historical CAGR of 13.04%).

- Formula: Future Value = Present Value × (1 + CAGR)^n, where n is the number of years.

2025 Share Price Forecast

- Projected Range: ₹480–₹570

- CAGR Applied: 10–12%

- Rationale: Analyst consensus predicts a median target of ₹526.15, driven by strong Q4 FY25 production (e.g., 310,000 tonnes of zinc) and domestic metal demand. Expansion in aluminum and oil & gas, coupled with a potential demerger, supports this growth.

2030 Share Price Forecast

- Projected Range: ₹775–₹1,000

- CAGR Applied: 10–12%

- Rationale: By 2030, Vedanta’s focus on sustainability, capacity expansion (e.g., 1.5 MTPA alumina refinery), and new market entries will drive growth. Analyst estimates suggest ₹800–₹850, but increased commodity demand in India and China could push prices higher.

2035 Share Price Forecast

- Projected Range: ₹1,800–₹2,300

- CAGR Applied: 10–12%

- Rationale: Vedanta’s long-term investments in green aluminum, semiconductors, and oil & gas exploration (e.g., ₹50,000 Cr in Assam) will bolster profitability. The company’s demerger into four entities could unlock value, with analyst targets around ₹2,250.

2050 Share Price Forecast

- Projected Range: ₹9,500–₹12,000

- CAGR Applied: 10–12%

- Rationale: By 2050, Vedanta’s net-zero carbon goal and leadership in metals critical for energy transition (e.g., zinc, aluminum) will drive exponential growth. Analyst projections of ₹11,500–₹12,000 align with global demand for sustainable resources.

Key Growth Drivers

- Diversified Portfolio: Operations across zinc, aluminum, oil & gas, and semiconductors reduce risk.

- Sustainability Initiatives: $5 billion investment for net-zero emissions by 2050 enhances investor appeal.

- Strategic Expansions: Investments in Odisha, Assam, and new sectors like nickel and semiconductors.

- High Dividend Yield: 7.37% yield attracts income-focused investors.

- Demerger Plans: Splitting into four entities could unlock shareholder value by 2025.

Risks to Consider

- Commodity Price Volatility: Fluctuations in global metal and oil prices impact revenue.

- High Promoter Pledge: 99.99% of promoter shares pledged raises governance concerns.

- Regulatory Challenges: Environmental regulations could increase operational costs.

Should You Invest in Vedanta Ltd?

Vedanta Ltd offers a compelling mix of growth potential, high dividends, and exposure to critical commodities. With a conservative CAGR of 10–12%, the stock could deliver significant returns by 2050. However, investors should monitor commodity prices, promoter activities, and regulatory developments. Consulting a financial advisor is recommended before investing.

Conclusion

Vedanta Ltd’s share price is poised for steady growth, with forecasts of ₹480–₹570 in 2025, ₹775–₹1,000 in 2030, ₹1,800–₹2,300 in 2035, and ₹9,500–₹12,000 in 2050. Backed by strong financials, strategic expansions, and a high dividend yield, Vedanta is a solid long-term investment. Stay updated on market trends and conduct thorough research to make informed decisions.

Disclaimer: This forecast is based on historical data, analyst estimates, and market trends. Stock prices are volatile, and past performance does not guarantee future results. Always seek professional financial advice before investing.

Add a comment Cancel reply

Categories

- Alcoholic Beverages (1)

- Cement (1)

- Commodities Trading (1)

- Consumer Finance (1)

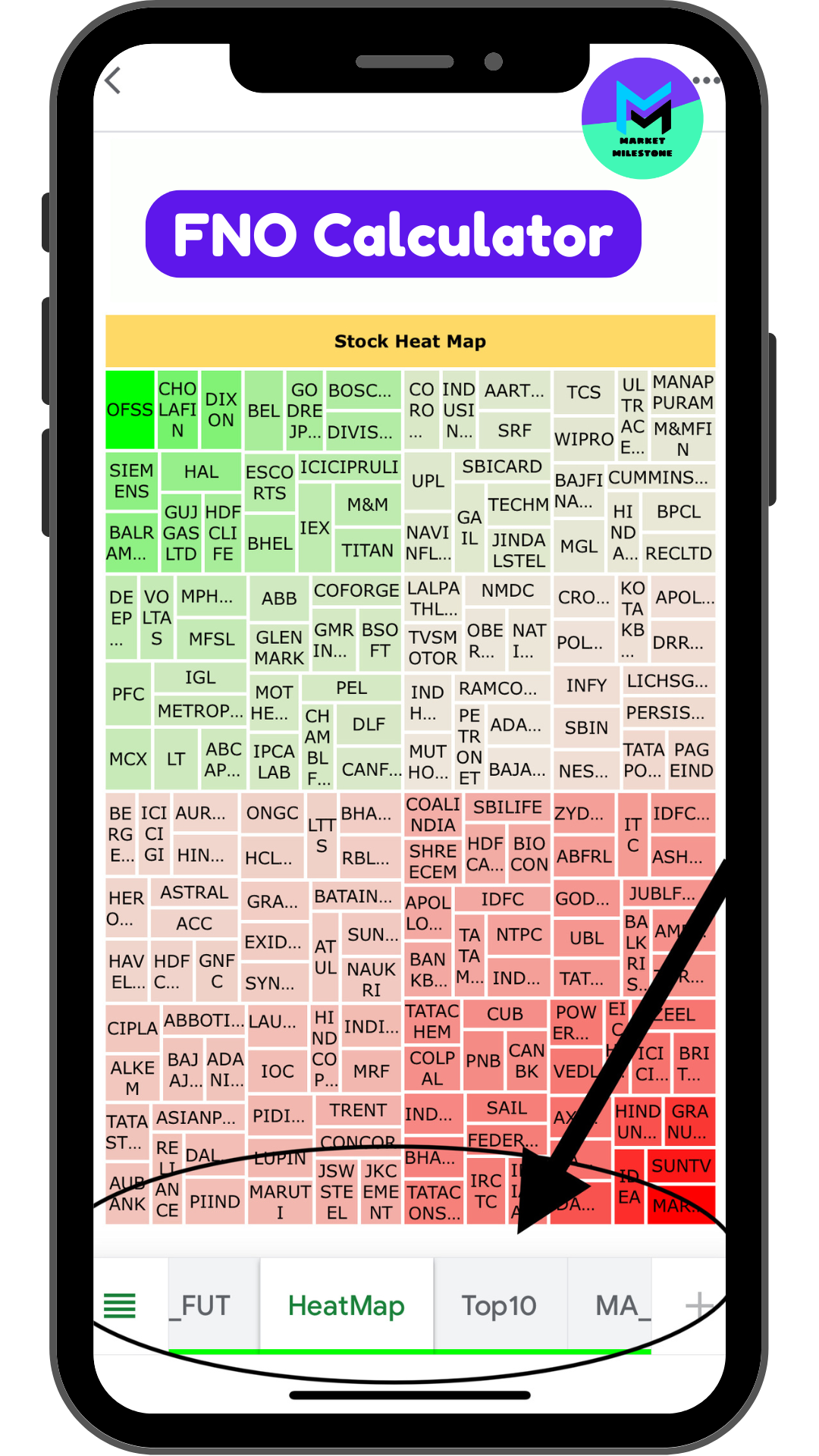

- FNO Calculator (3)

- Heavy Electrical Equipments (1)

- How to Use FNO (3)

- Iron & Steel (1)

- IT Services & Consulting (4)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (2)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (1)

- Retail – Apparel (1)

- Specialty Chemicals (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.